CRISPR Therapeutics (CRSP) recently reported earnings for its second quarter of Fiscal Year 2022. CRSP’s Adjusted earnings per share came in at -$2.40, which missed analysts’ consensus estimate of -$2.22. In addition, sales fell over 99% year-over-year, with revenue hitting $158,000 compared to $900.7 million. This massive difference is the result of a $900 million upfront payment in Q2 2021 from Vertex for a Joint Development and Commercialization Agreement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a result, shares have been trading lower since the report. In the past eight quarters, the company has beat estimates two times. Furthermore, CRSP had free cash flow of -$151.6 million. With such a heavy cash burn, the company needs a balance sheet with a sufficient cash position to sustain it. Fortunately, CRSP has $1.37 billion in cash, cash equivalents, and short-term investments.

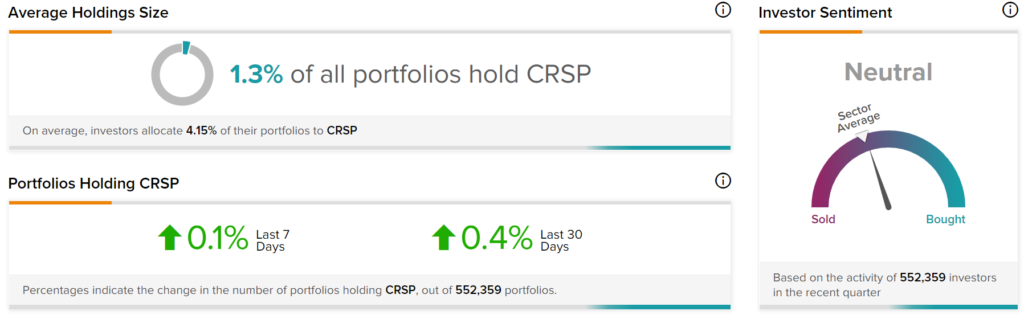

Investor Sentiment For CRSP Stock is Neutral

The sentiment among TipRanks investors is currently neutral. Out of the 552,359 portfolios tracked by TipRanks, 1.3% hold CRSP. In addition, the average portfolio weighting allocated towards CRSP among those who do have a position is 4.15%. This suggests that investors of the company are quite confident about its future.

Indeed, in the last 30 days, 0.4% of those holding the stock increased their positions. As a result, the stock’s sentiment is slightly above the sector average, as demonstrated in the following image:

Is CRSP Stock a Good Buy?

CRSP has a Moderate Buy consensus rating based on 10 Buys and seven Holds assigned in the past three months. The average CRSP price target of $100.44 implies 29.1% upside potential.

Top Analyst Gena Wang from Barclays was pleased that regulatory submissions for gene editing candidates were on track. Nevertheless, she downgraded the stock to a Hold and cut the price target to $88 per share due to the lack of data catalysts in the next 12 months.

Takeaway – CRSP Stock is Speculative, but Investors Remain Positive

CRSP is still a cash-burning company and isn’t expected to be profitable anytime soon, which makes it a speculative bet. Nevertheless, both analysts and investors have a favorable view of the company as they believe that it has a promising future in the long run.