Cybersecurity stock CrowdStrike (NASDAQ:CRWD) has already been fighting hard to make a name for itself. And it’s come a long way since its earliest days. Now, however, it’s taken to its own show stage to roll out some new developments that should catch customers’ attention. However, it’s left its own investors cold, as CrowdStrike dipped fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first major set of announcements came out of CrowdStrike’s Fal.con show. It revealed the Falcon Foundry, a new platform that gives users a range of tools to address cybersecurity concerns, as well as some information technology (IT) issues without having to do a lot of coding. Falcon Foundry lets users create their own apps that run on the Falcon platform, making it that much stronger and more customizable for the effort.

But that wasn’t all that CrowdStrike had to show. It also announced that it was purchasing another cybersecurity company, Bionic. The deal had been in the works for some time, and now, it’s gone live. The mostly cash deal—part of it is in stock, though that stock has some vesting conditions attached to it—was valued at around $350 million total. With Bionic in its arsenal, CrowdStrike will be able to add to its lineup of tools that help prevent security breaches from taking place to begin with.

Is CrowdStrike a Buy, Sell, or, Hold?

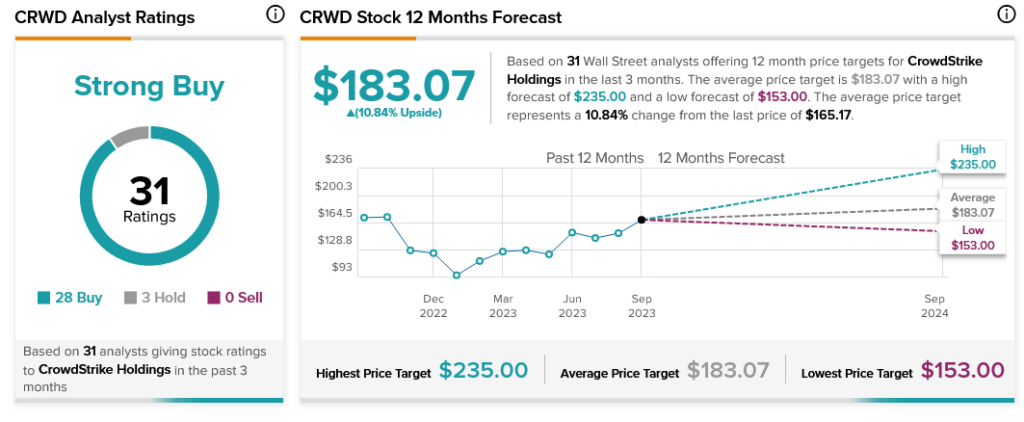

CrowdStrike itself, meanwhile, enjoys substantial analyst support. Analyst consensus calls CrowdStrike stock a Strong Buy, thanks to the combination of 28 Buy ratings and three Holds. Further, with an average price target of $183.07, CrowdStrike stock offers investors 10.84% upside potential.