Great news emerged out of biotech stock Crispr Therapeutics (NASDAQ:CRSP), particularly for those who suffer from sickle-cell anemia. A new treatment for the disease was created using the genetic modification tool, and it’s given Crispr stock a boost, up nearly 5% in Tuesday morning’s trading session.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The treatment in question, known as Casgevy, not only addresses sickle cell but also treats a similar issue known as “beta thalassemia,” both of which are inherited conditions and, thus, prime targets for a Crispr treatment that works on the genetic level. The United Kingdom accepted the treatment earlier today, note reports, and that represented a first-of-its-kind advancement. The treatment will reportedly be available to those over the age of 12, and a similar product known as Exa-cel also got a positive recommendation from the Food and Drug Administration in the U.S., which will make a final decision by December 8.

They’re Just Getting Started

Crispr’s CEO, Samarth Kulkarni, noted that this would not be the last such therapy to come out of Crispr’s genetic engineering capabilities, and several more were on tap. Crispr is most notably right now working on a means to treat cancers and other genetic conditions, including HIV, via a method that selects and culls certain parts of DNA that might lead to those conditions. Cancer is a mutation, so being able to remove or modify the parts of DNA that might become damaged and produce cancer would effectively take cancer off the playing field altogether. Can Crispr ultimately go that far? That’s unclear. But with one treatment already on the table, it stands to reason more could follow.

Is Crispr a Buy, Hold, or Sell?

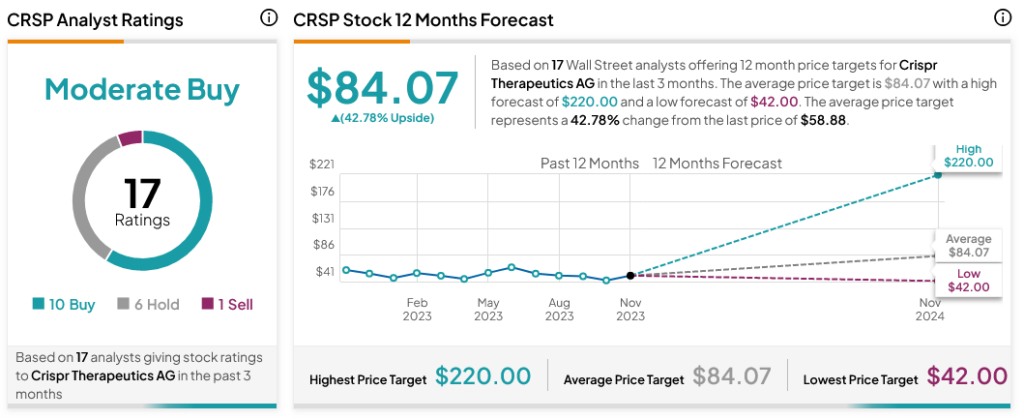

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRSP stock based on 10 Buys, six Holds, and one Sells assigned in the past three months, as indicated by the graphic below. After a 44% rally in its share price in 2023, the average CRSP price target of $84.07 per share implies 42.78% upside potential.