It’s never a good day when a bank has problems, but when a bank has to be propped up by a central bank in order to exist, that’s a massive red flag. For Credit Suisse (NYSE:CS), it’s discovering that the major lifeline it got from the Swiss central bank is starting to do about as much harm as good. Harm enough, in fact, to send its stock down over in Friday afternoon trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

When Credit Suisse started using the $50 billion lifeline the Swiss central bank established, it was thought that customers would feel better about things. And on a certain level, it makes sense. Credit Suisse can now draw on a line of credit that’s equivalent to Azerbaijan’s entire take for 2021. And then some. But the fact that Credit Suisse needed such a liquidity infusion in the first place is likely what’s so unsettling to investors. It’s not the size of the backstop but rather that it needed a backstop, to begin with.

Several points of concern are present. For one, premiums on Credit Suisse credit-default swaps—or contracts designed to protect investors in the event the bank can’t live up to its own contracts—are still quite high in price. Further, its “bail-in bonds,” the bonds that can be written down to zero in the event of a serious issue of liability, are around $0.29 on the dollar. That suggests that investors are concerned overall about the state of Credit Suisse and its potential for default. Indeed, markets worldwide are deeply concerned about bank defaults and the like, as noted by TS Lombard senior economist Davide Oneglia, stating that “…European banks are engulfed by a confidence crisis.”

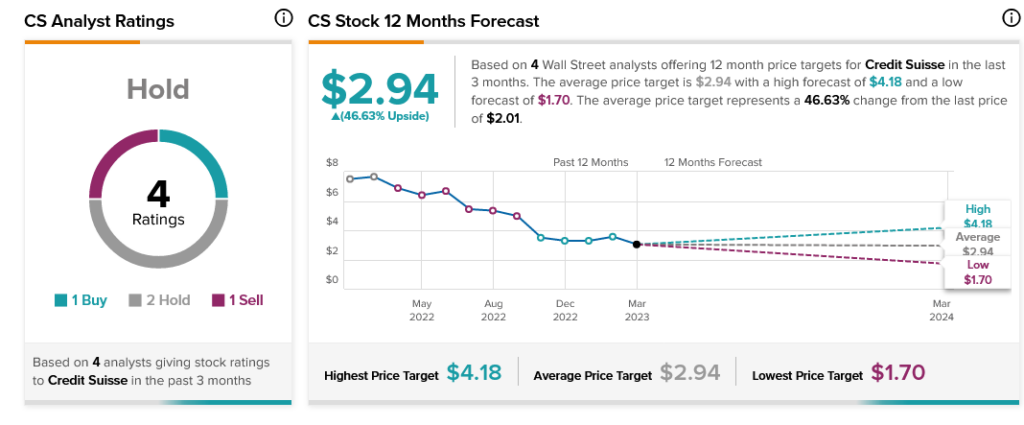

Right now, analysts are also concerned about Credit Suisse’s future. Currently, Wall Street consensus calls Credit Suisse stock a Hold with an average price target of $2.94 per share. Nevertheless, the stock comes with 46.63% upside potential.