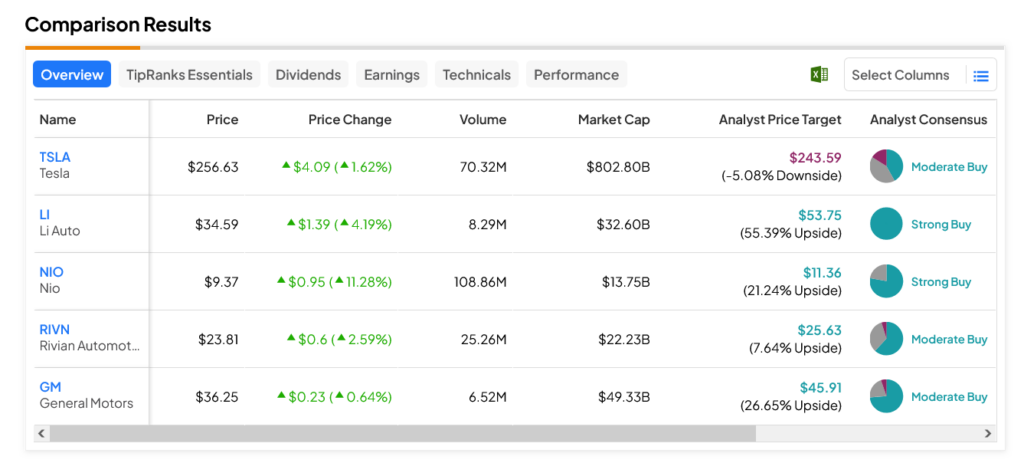

It’s been a long, strange year for electric vehicles and one for electric vehicle stocks, too. Yet, several of them are on the rise in Tuesday afternoon’s trading. This includes General Motors (NYSE:GM), Tesla (NASDAQ:TSLA), Rivian Automotive (NASDAQ:RIVN), and Li Auto (NASDAQ:LI). The winner, though, is Nio (NASDAQ:NIO), which was up over 11% at the time of writing. Interestingly, new projections from Cox Automotive suggest that electric vehicle availability will increase in 2024, causing prices to fall.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, everything we saw happen in 2023 to spark demand—price incentives, discounting, a downright price war between Tesla and most Chinese EV makers—will not only be in full force in 2024 but will come in at an accelerated pace. That, combined with rising inventories as consumers shy away from massive new purchases, like an EV, should result in a lot of dealers cutting prices in a bid to get somebody, anybody, on the lot to buy cars.

Not Even Used Electrics are Getting Sales

It’s a growing problem throughout the electric vehicle ecosystem, but as it turns out, drivers are not only turning up their noses at new electric vehicles, but they’re also not interested in used ones either. The biggest reason here is a lack of incentives; with no subsidies or price cuts on used electric vehicles, that’s turning potential buyers away. Meanwhile, there are signs that potential buyers are also waiting for technological improvements before jumping into EVs, not to mention improvements in charging infrastructure. It’s actually hard in many places to even find a charger, let alone the number that would be required to truly replace gas engines.

Which EV Stocks are a Good Buy Right Now?

Several EV stocks are on the rise in today’s trading, but some are doing much better than others. TSLA stock, for example, is the laggard in the field, as this Moderate Buy-rated stock offers a 5.08% downside risk on its average price target of $243.59 per share. Meanwhile, Strong Buy-rated Li Auto is the leader, with its $53.75 average price target yielding a 55.39% upside potential.