It sounds almost impossible, yet some investors are starting to wonder what would happen if Ethereum (ETH-USD) really did reach $100,000. At this level, Ethereum would no longer be just another cryptocurrency. It would become one of the largest financial ecosystems in history.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At a $100,000 price, Ethereum’s current circulating supply of around 121 million ETH would be worth nearly $12.1 trillion. This is more than three times Apple’s (AAPL) market capitalization and close to half the total value of gold. These are world-shifting numbers that could redefine what digital assets mean for global finance.

Ethereum at $100,000 Becomes Its Own Economy

If Ethereum reached six figures, about 36 million ETH or roughly 30% of supply would likely remain staked, which would represent around $3.6 trillion locked up in network security. At this scale, Ethereum would function as a global digital economy with its own financial infrastructure.

Every part of the network would expand in value. Transaction fees, validator rewards, and the amount of ETH permanently removed from circulation through burning would all rise in U.S. dollar terms. The entire system would start to resemble a digital nation with its own monetary policy and incentives.

Institutional Demand Could Be the Catalyst

Getting to $100,000 would require more than retail enthusiasm. It would take a steady flow of institutional money. Spot Ether exchange-traded funds (ETFs) have already shown that traditional investors are willing to buy and hold ETH.

If pensions, wealth managers, and retirement funds begin to treat ETH as a long-term asset class, their constant inflows could keep buying pressure high. This type of structural demand would provide stability instead of relying on hype or short-term speculation.

Another major force could come from tokenized dollars. Stablecoins and digital U.S. Treasury funds now move billions across Ethereum each day. As these assets grow, Ethereum becomes the main payment and settlement layer of the digital economy, which continually drives demand for ETH.

Scarcity and Staking Strengthen Ethereum’s Price

ETH’s design already supports long-term scarcity. The network burns a portion of transaction fees in every block, reducing supply over time. Meanwhile, staking continues to remove large amounts of ETH from circulation.

Overall, roughly a third of all ETH locked up, therefore the available supply in markets becomes increasingly limited. When this shrinking supply meets consistent institutional demand, the conditions for higher prices become stronger.

Security Spending Becomes Enormous

At $100,000 per ETH, the scale of Ethereum’s “security budget” would be staggering. The network pays validators in new ETH and fees to keep it secure. Even small changes in issuance would mean huge shifts in dollar terms.

If 100,000 ETH were issued in a year, validators would earn $10 billion. At 300,000 ETH, this number jumps to $30 billion. If the issuance reached 1 million ETH, the total security payout would reach $100 billion a year. These figures show how Ethereum’s economic size directly fuels its protection.

Ethereum Wants to Be Affordable for Users

At such a high price, ordinary users would not tolerate expensive transactions. This is why Ethereum’s Layer 2 networks are so important. These secondary systems handle most transactions for just a few cents while still using ETH to settle on the main chain.

The Dencun upgrade helped by introducing “blob” data storage, which reduced costs for these networks. This setup allows Ethereum to scale for millions of users while keeping fees manageable and still ensuring ETH remains central to the entire system.

ETFs, DeFi, and Stablecoins Power the Engine

If ETH did climb to $100,000, it would likely be driven by several forces working together. ETFs would create consistent buying pressure from long-term investors. DeFi (decentralized finance) would expand as higher prices increase the value of collateral and boost lending activity.

Stablecoins would keep the system running smoothly by providing liquidity for payments and trading. Together, these elements could sustain a healthy balance between buying, staking, and burning ETH, keeping the ecosystem active and valuable.

Here Are the Risks that Could Derail It

Rapid growth brings new dangers. A multitrillion-dollar Ethereum would attract much closer scrutiny from global regulators. Oversight of staking providers, liquid staking tokens, and ETFs would increase sharply.

Technical risks would also rise. Larger stakes mean higher rewards for attackers, making network decentralization and validator diversity even more important. Any sign of centralization or technical weakness could trigger sharp market reactions.

Key Takeaway

Reaching $100,000 per ETH would take years of consistent growth, stable regulation, and strong technical execution. It would not happen overnight or from a single upgrade. It would depend on a deep integration of Ethereum into global finance, where everything from digital dollars to investment funds depends on its infrastructure.

If that vision becomes real, Ethereum would evolve from a blockchain network into a core part of the world’s economic system. It would represent a new era in how technology, money, and trust connect — and show just how far one decentralized idea can go.

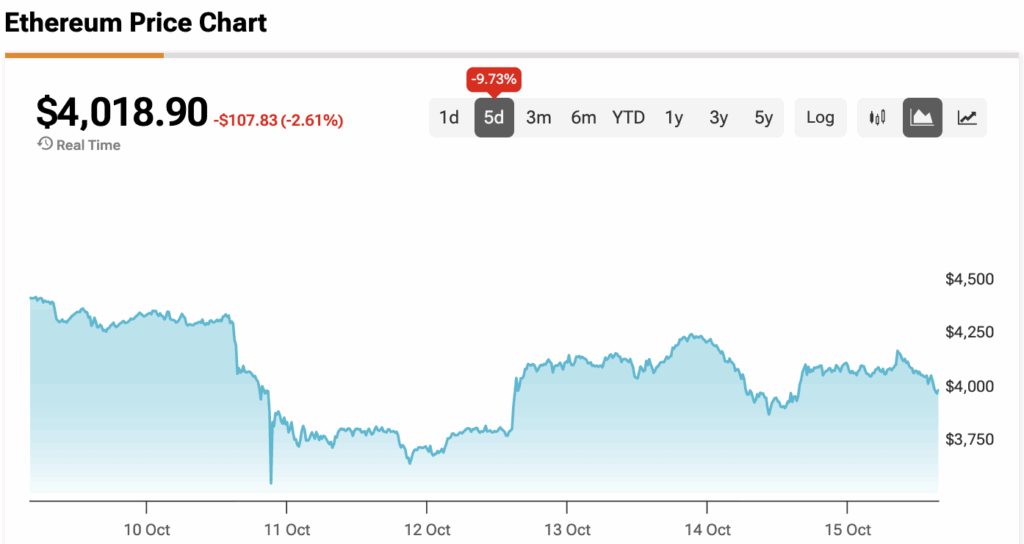

At the time of writing, Ethereum is sitting at $4,018.90.