An already strained global economy faces a new challenge after China announced export controls on certain gallium and germanium products. The country is the largest name in gallium in the world and accounts for over half of the germanium produced globally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The restrictions are expected to go into effect from August 1 and come even as the U.S. plans further trade restrictions on China. Companies will now be required to seek licenses to export the products and this puts the spotlight on AXT Inc. (NASDAQ:AXTI) which provides semiconductor substrate wafers made up of indium phosphide, gallium arsenide, and germanium.

AXTI has its primary subsidiary as well as three manufacturing facilities in China. The company also owns partial stakes in ten companies engaged in the production of the necessary raw materials in the country.

Consequent to the export controls, AXTI’s subsidiary, Tongmei, plans to immediately seek the necessary permits for the export of gallium and germanium products. Morris Young, the company’s CEO commented, “We are actively pursuing the necessary permits and are working to minimize any potential disruption to our customers.”

Notably, nearly 22.2% of AXTI’s first quarter revenue came from exports of gallium arsenide and germanium substrate exports from China. These products are used in varying applications across consumer, automotive, industrial, and display markets.

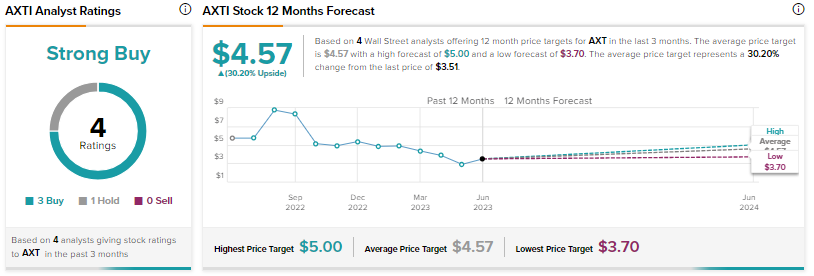

Overall, the Street has a Strong Buy consensus rating on AXTI alongside a $4.57 consensus price target. While shares of the company have tanked nearly 38.4% over the past year, the consensus price target points to a 30.2% potential upside in the stock.

Read full Disclosure