Until two weeks ago, hardly anyone would have thought cryptocurrencies could be a fast safe haven. But then, on Wall Street fortunes can turn quickly. Since the beginning of the SVB Saga on March 8, Bitcoin (BTC-USD) and Ethereum (ETH-USD), the two major cryptocurrencies, have been on a tear with BTC outperforming ETH.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

BTC has rallied 66% year-to-date and ETH has gained nearly 45%. This indicates BTC still continues to act as a preferred refuge of safety over ETH.

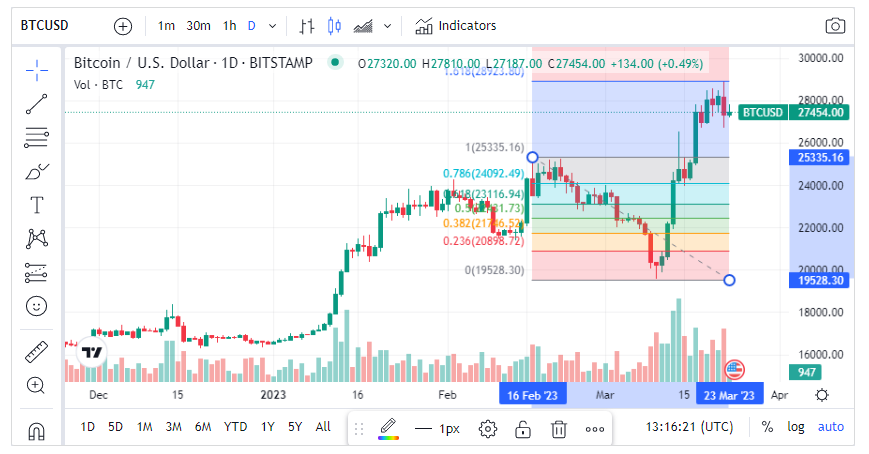

Importantly, from its March 10 low of $19,528, BTC rebounded to the $22,000 level and made a Fibonacci retracement of 1.6 on March 2022. ETH though failed to scale a similar peak.

Next, once again, cryptocurrency proponents will clamor about the value the crypto coins provide at a moment of peril (and maybe rightly so). Next, the $32,000-$33,000 remains an important level to cross so the crypto-bell-weather can continue on the path of recovery. ETH though could face immediate resistance at $2,100 at continue to underperform BTC.

One thing is certain, amid the spate of rate hikes globally and ever-tightening credit conditions, more banking dominos could be getting ready to tumble.

Read full Disclosure