Shares of Japan-based Seven & i Holdings (JP:3382) are gaining traction today after Canadian rival Alimentation Couche-Tard ($TSE: ATD) expressed its willingness to revive discussions following the rejection of its $38.5 million cash bid last week. On Friday, Seven & i rejected the non-binding acquisition proposal from Couche-Tard, citing that the offer undervalues the company and overlooks significant regulatory hurdles.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nonetheless, Couche-Tard remains strongly committed to completing a deal with Seven & i that benefits all parties involved. Seven & i shares gained nearly 3% as of writing.

Seven & i Holdings is a parent company overseeing a diverse portfolio of businesses through its subsidiaries. Meanwhile, Alimentation Couche-Tard is a Canadian retail group that runs a global network of convenience stores, including the popular U.S. chain Circle K.

Seven & i Could Resume Negotiations with Couche-Tard

Responding to the news of Alimentation Couche-Tard’s inclination to resume takeover talks, Seven & i stated that it is willing to continue discussions if future offers accurately reflect the company’s inherent worth and ensure a clear path to closing the deal.

Peeking into the backdrop, Seven & i received a record takeover bid from Couche-Tard last month, making it the largest Japanese target for foreign acquisition. The news boosted Seven & i’s market capitalization to over $39 billion. Shortly after that, the talks came under the radar of the antitrust regulators in the U.S., where much of 7-Eleven’s business operates. However, Couche-Tard stated that it is open to considering divestitures necessary for regulatory approvals.

What Is the Price Target for 7-Eleven Stock?

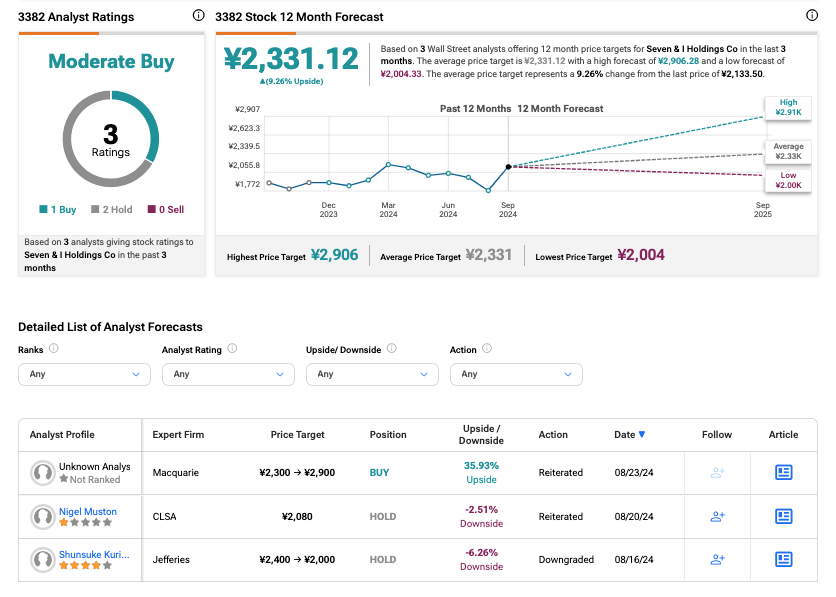

As per the consensus among analysts on TipRanks, 3382 stock has been assigned a Moderate Buy rating based on one Buy and two Hold recommendations. The Seven & i Holdings share price target of ¥2,331.12 implies an upside of 9.3% from the current share price level.