Coty Inc. (COTY) shares edged higher after the cosmetics giant announced a strategic review of its CoverGirl and other mass-market beauty brands. The company said it is exploring options, including a potential sale or spinoff. Coty has appointed Citi as its advisor to guide the strategic review. Following the announcement, COTY stock gained 1.75% in pre-market on Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Coty is known for its diverse portfolio of fragrance, cosmetics, and skincare brands. Meanwhile, CoverGirl is among the world’s most well-known mass-market makeup brands, offering affordable and accessible beauty products.

Coty Shifts Focus to Profitable Segments

Coty’s strategic review aims to focus on its premium fragrance and skincare portfolio, with particular attention on its more profitable fragrances unit. The company had previously invested heavily in its U.S. mass beauty business, but as the segment faltered under pressure from cheaper online competitors, Coty shifted its focus back toward its more resilient fragrance unit.

As part of the review, Coty will examine its $1.2 billion mass-market color cosmetics segment, including CoverGirl, Rimmel, Sally Hansen, and Max Factor, exploring all possibilities such as partnerships, divestitures, or spin-offs. It will also review its standalone Brazil business.

Additionally, the company has combined its Prestige and Consumer Beauty fragrance brands into a single division, including well-known names like Gucci (PPRUY), Calvin Klein, Hugo Boss (BOSSY), Vera Wang, and David Beckham. This unified segment remains the main driver of the company’s revenue and profits, while Coty continues to support steady growth in its cosmetics and skincare business.

Coty Signals Weak Demand in Latest Results

Last month, Coty released its Q4 and FY25 results, highlighting weaker demand for its beauty products. Notably, Consumer Beauty net revenue declined 8% year-over-year on a reported basis.

Overall, U.S. retailers have become cautious amid tariffs and rising costs, cutting inventories as consumers pull back on spending for beauty and skincare products.

Is COTY Stock a Good Buy?

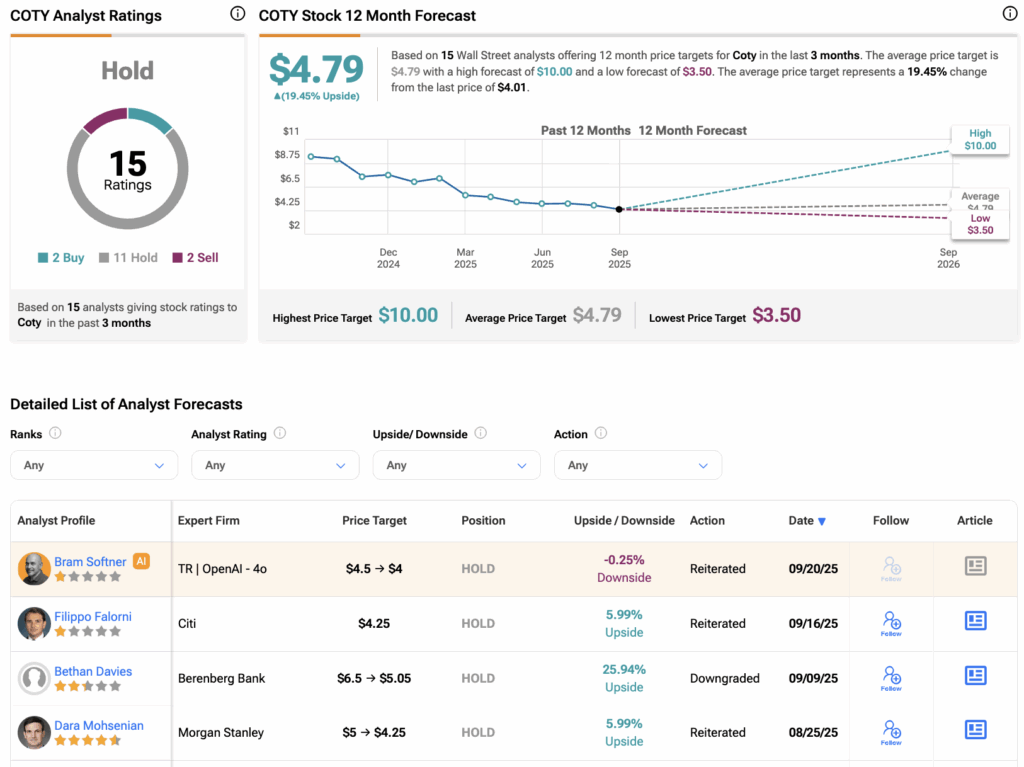

According to TipRanks, COTY stock has received a Hold consensus rating, with two Buys, 11 Holds, and two Sells assigned in the last three months. The average stock price target for Coty is $4.79, suggesting a potential upside of over 19% from the current level.