Shares of Coty (NYSE:COTY) are rising higher in pre-market trading today after the company raised its outlook for the fourth quarter and Fiscal year ending 2023. The French-American beauty company lifted its forecast thanks to strong demand for its Prestige Brands and a resurgence in demand from China. Coty is also aiming to strengthen its presence in the European nation, with an initial public offering (IPO) planned in Paris. COTY stock is up more than 1.8% as of the last check.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Details of the Revised Outlook

Coty announced the revised forecast at its first-ever investor conference held in Paris today. Through the dual listing on Paris Euronext, Coty hopes to gain the loyalty of the European investor community.

As per the updated outlook, Coty now expects its Q4FY23 revenue to grow between 12% and 15% on a like-for-like (LFL) basis, up from the earlier forecast of +10% growth. For FY23, it expects core revenue growth between 10% and 11% on an LFL basis (up from 9% to 10%). Additionally, FY23 adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) is forecasted between $965 to $975 million, including a $70 million negative foreign exchange impact. Further, for the current year, Coty will retain its leverage of 3x and improve it to 2x by the end of 2025.

Commenting on the occasion, Sue Nabi, CEO of Coty, said, “By combining our robust operational and financial performance and diverse team of beauty experts, we are accelerating our position as a global leader in fragrances and cosmetics. Together, we are realizing significant untapped potential in areas such as ultra-premium skincare, ultra-premium scenting, China, Brazil, and Travel Retail.”

Is COTY Stock a Good Buy?

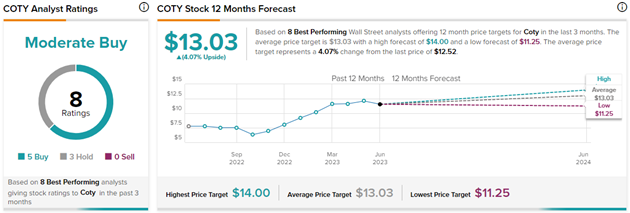

Ahead of the conference, Bank of America analyst Anna Lizzul reiterated a Buy rating on COTY with a price target of $14, implying 11.8% upside potential. Overall, Wall Street is cautiously optimistic about Coty. Meanwhile, COTY has gained 42.8% so far this year.

On TipRanks, out of the eight top analysts who recently rated COTY, five have given it a Buy rating and three have given it a Sell rating. Top Wall Street analysts are those awarded higher stars by TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings). Based on the top analysts’ views, the average Coty price target of $13.03 implies 4.1% upside potential from current levels.