Coty (NYSE:COTY) shares are under pressure in the pre-market session today after the beauty products provider launched a global offering of 33 million of its Class A shares to the public in the U.S. and on a private placement basis to investors outside the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Further, Coty has applied for the listing of its Class A shares on the professional segment of Euronext Paris. It plans to use the funds raised to primarily pare down its debt as well as for general corporate purposes.

The company aims to manage the number of its outstanding shares via the discretionary settlement of one or more of its outstanding total return swaps. While the company has not announced a definite transaction at present, it expects any such settlement amount not to exceed 27 million shares.

Today’s price decline comes after a nearly 66% surge in Coty shares over the past year. The company recently announced a robust financial outlook for the full Fiscal year 2024 on the back of strong demand and successful product launches. At the time, it indicated managing its share count at about 800 million.

Is Coty a Good Stock to Buy?

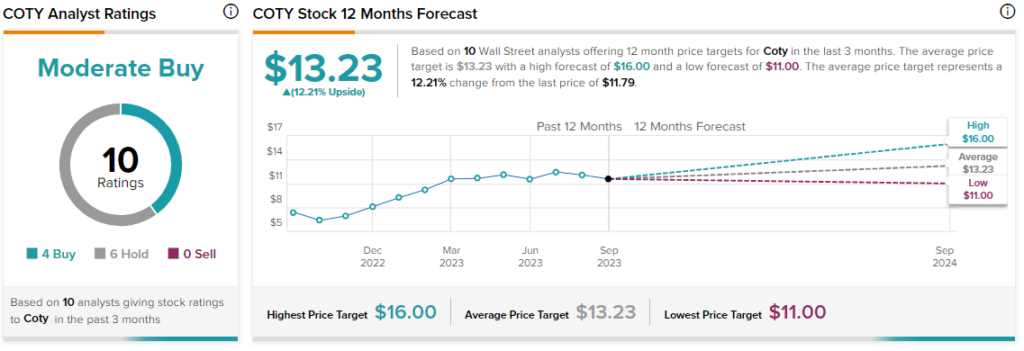

Overall, the Street has a consensus price target of $13.23 on Coty, alongside a Moderate Buy consensus rating.

Read full Disclosure