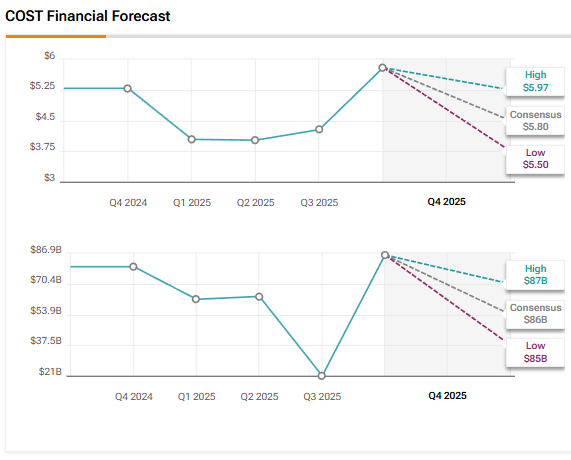

Membership-only warehouse chain Costco Wholesale (COST) is scheduled to announce its results for the fourth quarter of Fiscal 2025 after the market closes on Thursday, September 25. COST stock has risen 3% year-to-date. While Costco bulls highlight the company’s resilient performance and a loyal member base, other analysts are concerned about the stock’s steep valuation and a slowdown in sales momentum. Wall Street expects Costco to report Q4 FY25 earnings per share (EPS) of $5.80, reflecting a 9.6% year-over-year growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, Q4 FY25 revenue is expected to rise 8% year-over-year to $86.01 billion.

Analysts’ Views Ahead of Costco’s Q4 Earnings

Heading into Q4 FY25 results, UBS analyst Michael Lasser reiterated a Buy rating on Costco stock with a price target of $1,205. Lasser noted that there has been a debate on whether the retailer has enough levers to maintain its momentum. “We believe it does,” said Lasser. The 5-star analyst explained that these concerns resulted mainly from softer comparable sales growth (comps) trends in May and June, with some market participants raising questions about COST stock’s elevated multiple amid slowing comps.

Lasser thinks that the market was looking at those results in isolation. Moreover, Costco’s comps and traffic reaccelerated in July-August, which the analyst believes would have mitigated these concerns. Looking ahead, Lasser expects Costco to sustain its momentum, driven by its best-in-class merchandising and other catalysts in the upcoming months and quarters. “We expect it to uphold its premium valuation,” concluded Lasser.

Additionally, Raymond James analyst Bobby Griffin reiterated a Buy rating on Costco stock with a price target of $1,070. The 5-star analyst noted that Costco’s valuation multiple is near its one-year trough, while the positive fundamentals of the company’s business model, which make it a long-term compounder and market share gainer, remain well intact. Griffin added that Costco’s Q4 FY25 comparable sales reflected these aspects.

Griffin contends that COST stock deserves a premium valuation, given its consistent execution, defensive category mix, and strong member loyalty. Looking ahead, the analyst expects 25 net new annual store openings, broad-based share gains across food and non-food categories, and enough flexibility for reinvestment and shareholder returns. Griffin is also bullish on Costco due to several other strengths, including its supply chain capabilities, strong vendor relationships, pricing discipline that enables it to navigate any tariff-related pressures, and value proposition.

AI Analyst Is Cautious on Costco Stock Ahead of Q4 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Costco stock with a price target of $1,071, indicating about 13.5% upside potential. TipRanks’ AI analysis reflects strong financial performance and favorable earnings call insights, slightly offset by concerns over high valuation and mixed technical indicators.

Overall, the AI Analyst’s rating highlights Costco’s solid revenue growth, strategic expansion, and solid cash flow.

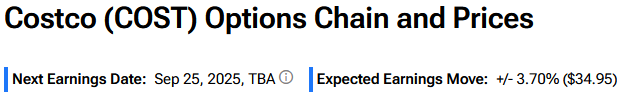

Here’s What Options Traders Expect from Costco’s Q4 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 3.7% move in either direction in COST stock in reaction to Q4 FY25 results.

Is COST Stock a Good Buy?

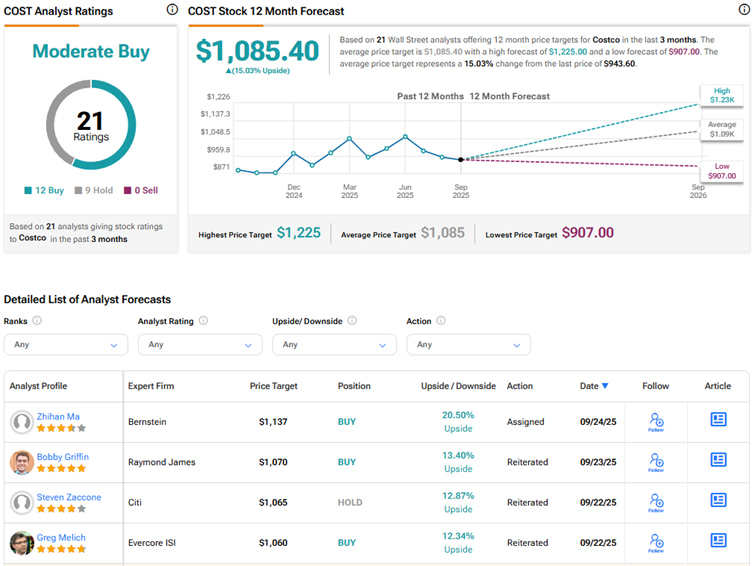

Overall, Wall Street has a Moderate Buy consensus rating on Costco stock based on 12 Buys and nine Holds. The average COST stock price target of $1,085.40 indicates 15% upside potential from current levels.