Big-box retailer Costco (NASDAQ:COST) reported net sales of $23.8 billion in December 2022 (five weeks ended January 1, 2023), reflecting an increase of 7% year-over-year. The company’s monthly performance might have benefitted from elevated demand for affordable products during the holiday season.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Comparable sales were up 5.5%, with sales growth across the U.S., Canada, and international markets. However, the company’s comparable e-commerce sales declined by 6.4%, reflecting consumers’ preference to shop at Costco’s retail stores due to affordable prices.

Excluding the impact of changes in gasoline prices and foreign currencies, Costco’s comparable sales in December grew 7.3%, while e-commerce comparable sales were down 5.4%.

Furthermore, the company witnessed a 7.6% jump in net sales to $82.16 billion for the 18 weeks that ended on January 1, 2023. This comes despite lower fuel prices and foreign exchange headwinds impacting its top line.

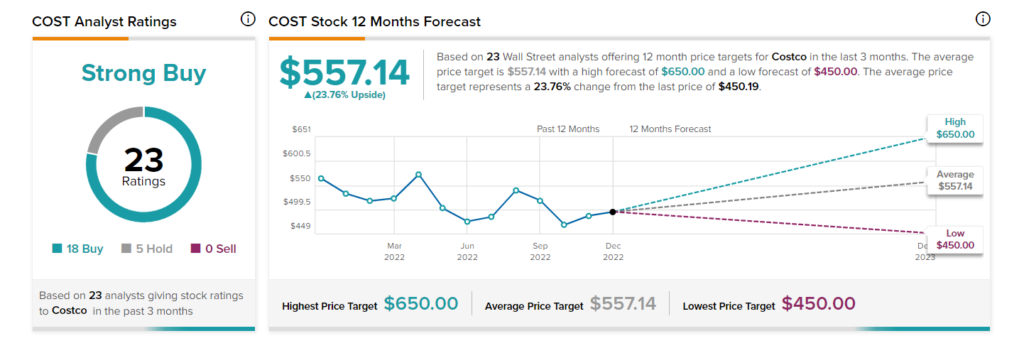

Is COST Stock a Good Buy?

Overall, the Street is optimistic about the stock. COST enjoys a Strong Buy consensus rating based on 18 Buys and five Holds. The average Costco price target of $557.14 implies 23.8% upside potential from the current level. Shares have tanked 8.3% over the past six months.