Shares of Costco (NASDAQ:COST) rallied in today’s trading after a Stifel analyst note praised the retailer’s growing market share in groceries and gas. According to analysts Mark Astrachan and Christopher Bond, 12% of U.S. grocery dollar growth from 2019 to 2023 can be attributed to Costco and Amazon (NASDAQ:AMZN) due to their loyalty programs, digital offerings, and high level of value and convenience they provide.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Costco and Amazon have also been responsible for 23% of category growth since 2019 until now despite making up only 12% of sales. These gains came from segments like traditional grocery, convenience, and drug stores, with Costco also taking gas market share from convenience stores. As a result, Stifel raised Costco’s price target to $900 and maintained a Buy rating, as potential membership fee increases will act as a positive catalyst for the stock.

It’s worth noting that, so far, Astrachan has enjoyed a 96% success rate on COST stock, with an average return of 25.87% per rating.

Is COST Stock a Buy or Sell?

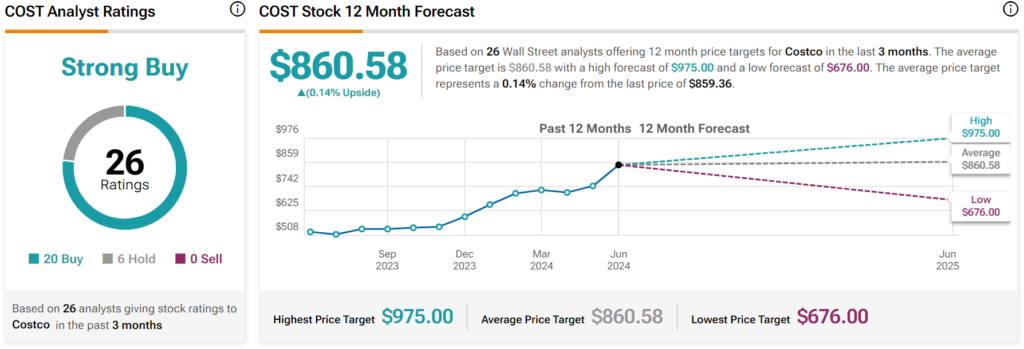

Turning to Wall Street, analysts have a Strong Buy consensus rating on COST stock based on 20 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 63% rally in its share price over the past year, the average COST price target of $860.58 per share implies that shares are fairly valued.