American big box retailer Costco Wholesale Corporation (NASDAQ:COST) announced yesterday that its board of directors has reauthorized a $4 billion share buyback program through January 2027. The new program would replace the current $4 billion stock repurchase program that expires in April 2023. The company bought roughly $1.4 billion worth of stock under the previous program.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Additionally, the board declared a quarterly common dividend of $0.90 per share. The same will be payable on February 17, 2023, to shareholders of record on February 3, 2023. Following the announcement, COST stock drove up 1.3% in the after-hours trading on January 19.

Will Costco Stock Go Back Up?

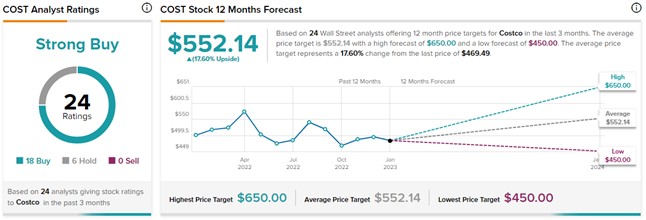

Wall Street analysts are highly bullish about Costco’s price trajectory. On TipRanks, COST stock commands a Strong Buy consensus rating based on 18 Buys and six Hold ratings. The average Costco Wholesale price target of $552.14 implies 17.6% upside potential from current levels. Meanwhile, COST stock has gained 3.6% since the start of 2023 vis-à-vis losing 10.1% in the past six months.

Join our Webinar to learn how TipRanks promotes Wall Street transparency