Shares of Costco (NASDAQ:COST) saw a slight bump in after-hours trading after the discount retailer reported its monthly sales figures and boosted its dividend. In March, the firm saw sales increase by 9.4% year-over-year to $23.48 billion. Roughly 0.5% of that increase can be attributed to Easter, which occurred at the end of March as opposed to April in 2023.

Costco’s year-to-date revenue was also positive, coming in 6.4% higher at $146.64 billion. As a result, the company upped its quarterly dividend by 13.7% to $1.16 per share. However, this is unlikely to cause any enthusiasm given that its closing share price of $722.58 implies a minuscule annualized dividend yield of 0.64%.

Is COST Stock a Buy or Sell?

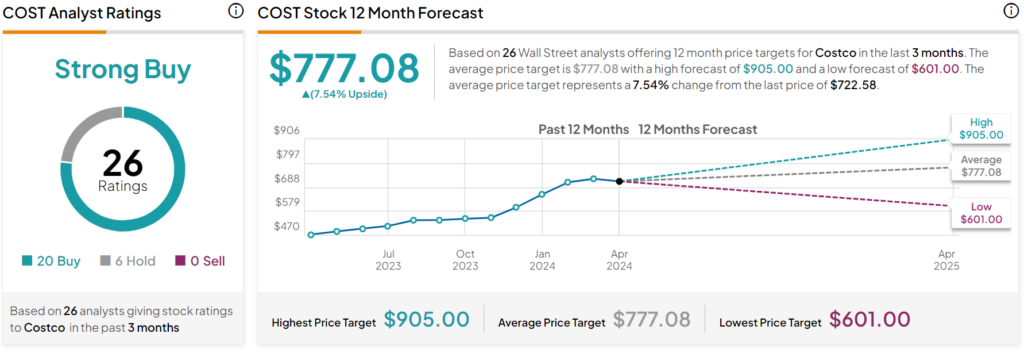

Turning to Wall Street, analysts have a Strong Buy consensus rating on COST stock based on 20 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 48% rally in its share price over the past year, the average COST price target of $777.08 per share implies 7.54% upside potential.