Shares of media content company Corus Entertainment (TSE:CJR.B) are currently down 25% after the company released its Q4 and Fiscal 2023 results. While its earnings per share (EPS) and revenue came in ahead of expectations — EPS of -C$0.04 vs. -C$0.09 expected and revenue of C$338.8 million vs. C$329 million expected — the company suspended its dividend and expects its business to decline next year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Diving into its financial results, CJR reported flat consolidated revenue for the quarter but a 5% decrease for the year. Meanwhile, its adjusted earnings of -C$0.04 came in better than last year’s figure of -C$0.08.

The company also mentioned increased debt ratios, as its net-debt-to-segment profit came in at 3.62, higher than Q4-2022’s figure of 3.02. Nonetheless, Corus reported free cash flow of $31.7 million for Q4 and $106.8 million annually.

Why Corus Suspended Its Dividend

Regarding its dividend suspension, the reason for it is so that Corus can repay its debt faster amid an uncertain economy and other sector-specific headwinds. These headwinds, according to the company, include “the impact of the extended Writer’s Guild of America (“WGA”) strike plus the “ongoing labour action of Screen Actors Guild-American Federation of Television and Radio Artists (“SAG-AFTRA”) on audience levels, advertising demand and revenue.”

Not a Bright Outlook

Amid economic challenges and industry strikes, the company forecasts a 15-20% decrease in TV advertising revenue for Q1 2024 and stated that while it expects business to normalize in the medium term, visibility remains “limited at this time.”

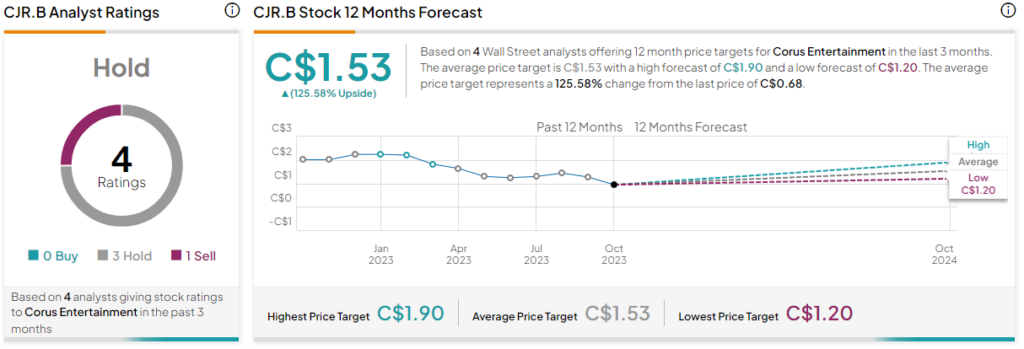

Is Corus Entertainment Stock a Buy, According to Analysts?

According to analysts, CJR.B stock comes in as a Hold based on three Holds and one Sell rating assigned in the past three months. The average CJR.B stock price target of C$1.53 implies 125.6% upside potential.