At its Investor Day held yesterday, Corteva Agriscience (CTVA) revealed restructuring plans that included laying off 5% of its global workforce. The company also announced a $2 billion share buyback plan.

Following the news, CTVA stock jumped nearly 2.8% in mid-day trading and continued the run in after-hours trading.

As per a WSJ report, the seed and chemical supplier company has decided to lay off 5% of its workforce. The company is restructuring its businesses to curtail costs related to employees, raw materials, and logistics, thus saving around $200 million by 2025. Moreover, these restructuring plans will cost the company approximately $400 million through the second quarter of 2023.

Corteva aims to focus on five core crop groups, including fruits & vegetables, soy, cereals, corn, and rice. In addition, it expects to spend about 8% of its sales on research & development (R&D). Moreover, the company has decided to focus on its operations in 110 countries, which includes 20 of its key regions across North America, Europe, and Brazil.

Furthermore, the company’s board of directors also authorized an additional $2 billion of share repurchases, which will be added to its existing $650 million outstanding under the share buyback program as of June 30.

Commenting on the strategy, Robert King, Executive VP of Corteva’s crop protection business said, “We’re going to balance the portfolio with new products coming out of the pipeline and filling the gaps with strategic partnerships in biologicals and seed applied technologies.”

Is Corteva a Buy, Sell or Hold?

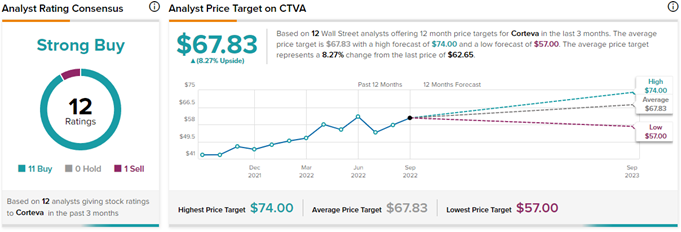

On TipRanks, CTVA stock commands a Strong Buy consensus rating. This is based on 11 Buys versus one Sell. The average Corteva price target of $67.83 implies 8.3% upside potential to current levels. Remarkably, CTVA stock has gained 34.6% so far this year.

Ahead of Corteva’s Investor Day, analyst Chris Parkinson of Mizuho Securities reiterated a Buy rating on the stock and kept the price target unchanged at $69. This implies 10.1% upside potential to current levels.

Parkinson anticipated that the company would make three major announcements related to seed and product growth targets, new cost programs, and R&D. The analyst had expected the stock price to react positively to the news, which it did.