Agricultural chemical and seed giant Corteva (NYSE:CTVA) has filed a lawsuit against Inari Agriculture in a federal court in Delaware, accusing the seed technology company of intellectual property theft. The company has alleged that Inari illegally procured Corteva seeds, made slight genetic modifications, and is now seeking patents in the U.S. for those modified traits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per a Wall Street Journal report, Corteva claims that Inari began stealing its technology in 2020 via the American Type Culture Collection (ATCC), a non-profit depository of seeds. Further, Inari used a separate seed-distributor company to buy Corteva’s proprietary seeds from the ATCC and then had them illegally shipped out of the U.S. to Belgium.

In the lawsuit, Corteva stated that it found out that Inari had its seeds during a video conference with the start-up’s CEO in 2021. Inari reportedly tried to coax Corteva to enter into a “quid pro quo” agreement, under which Inari said that it would not sell certain corn seeds containing Corteva’s technology if Corteva agreed to pay the start-up for the use of its soybean products.

Though Inari has not yet sold any gene-edited products from Corteva’s seeds, the latter claims that the start-up intends to commercialize them. Overall, Corteva intends to prevent Inari from stealing its patent-protected products and is seeking damages as well as a permanent injunction against the start-up.

Is Corteva Stock a Buy?

Corteva stock has declined about 14% year-to-date. Last month, the company lowered its full-year sales guidance due to weak demand for crop protection products like herbicides and insecticides. The company’s Q2 2023 sales declined 3% to $6.1 billion, as higher sales from seed business were more than offset by a 29% drop in volumes in its crop protection division.

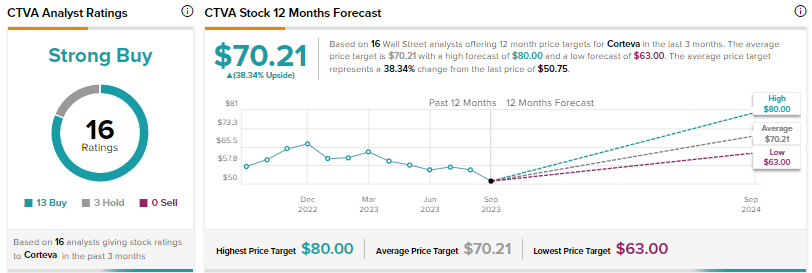

Nonetheless, Wall Street remains bullish on CTVA stock, with a Strong Buy consensus rating based on 13 Buys and three Holds. The average price target of $70.21 implies 38.3% upside potential.

Earlier this week, Berenberg analyst Aron Ceccarelli lowered the price target for Corteva stock to $63 from $68 but maintained a Buy rating. The analyst thinks the industry is taking a more proactive approach by reducing some of its manufacturing in the second half of the year. Ceccarelli continues to expect Corteva to achieve its 2025 outlook, although he noted that it would be at the lower end of the sales and operating EBITDA range provided at the company’s capital markets day.