Famous American investor, Peter Lynch said, “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise,” – so here are two British stocks which have seen insider activity in the past week.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

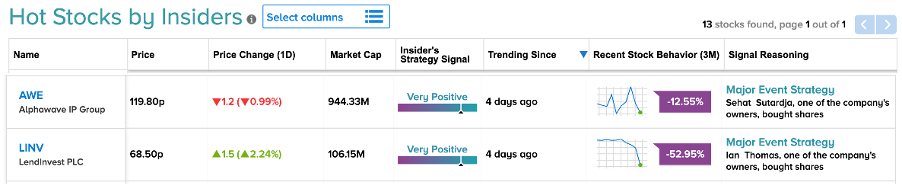

Both technology company Alphawave IP Group (GB:AWE) and mortgage lender LendInvest Plc (GB:LINV) saw heavy insider activity in the past few days.

Insider trading can offer valuable advice to potential investors. It is critical to consider how quickly investors can analyse and apply information to generate better returns for their portfolios.

The various tools offered by TipRanks can guide investors in such situations. One such tool is Insider’s Hot Shares, which shows the insider’s trading activities in different companies. It includes buying and selling of shares by top management, directors, executives, and more.

Based on this backdrop, we have shortlisted two stocks that saw heavy insider activity in the last week:

Let’s discuss the stocks in detail.

Alphawave IP Group

Alphawave designs high-speed connectivity solutions for technology infrastructure.

The company has been profitable since 2018, just one year after its start, and has witnessed tremendous growth in its revenues. In the recently issued trading update for the third quarter of 2022, the company reported a growth of 245% in new bookings.

However, shareholders still await the same momentum in the company’s share price, which has fallen by more than 50% in the last year.

As per TipRanks, corporate insiders have bought £3 million worth of shares in the last three months. This indicates a positive insider confidence signal around the company.

Last week, the company was leading the list of insider deals after Sutardja Family LLC acquired more shares.

The company’s executive director, Sehat Sutardja, bought shares in multiple rounds over the last week. On Monday, Sutardja spent £2 million and bought 1,829,871 shares, and bought another 3,48,179 shares on Tuesday.

After the recent activity, the family now owns a total of 91.2 million shares, which is around 13.2% of the company.

Is Alphawave a buy?

According to TipRanks’ analyst rating consensus, Alphawave stock has a Moderate Buy rating, based on one Buy recommendation.

The AWE target price is 260p, which represents a 117% change in the price from the current level.

LendInvest Plc

LendInvest is an asset management platform providing mortgages, loans, and development finance to landlords, intermediaries, and builders across the UK.

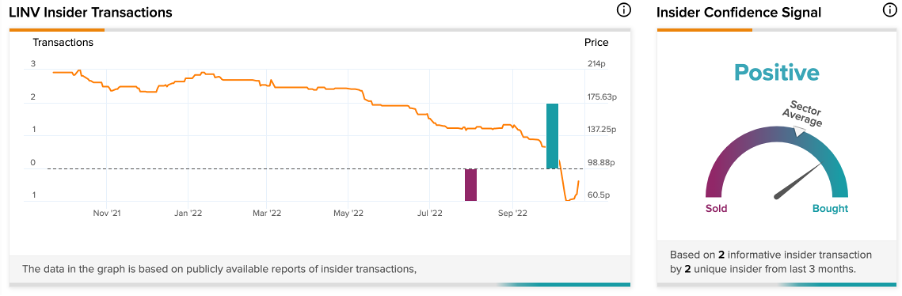

The company’s stock is going through a rough phase due to difficult conditions in the mortgage market. The stock has fallen by 42% in the last three months.

Despite this, the company posted positive numbers in a half-year update. The company’s assets under management grew by 33% to £2.4 billion and the funds under management grew by 20% to £3.4 billion.

According to TipRanks data, corporate insiders have bought £56,500 worth of shares in the last 3 months.

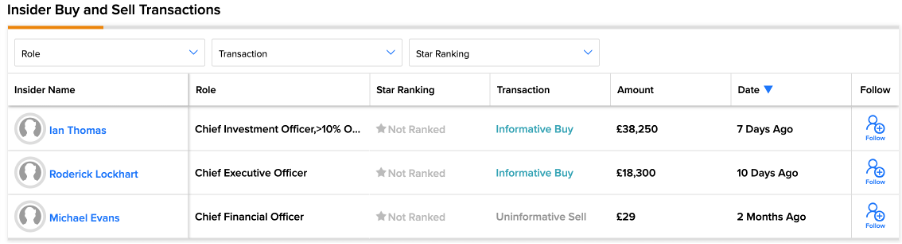

The company’s chief executive, Roderick Lockhart, made an informative buy of 27,111 shares for £18,300 on October 11, 2022. His total holding in the company is around £2.47 million.

Last week, Ian Thomas, the chief investment officer, acquired 60,000 shares of the company for £38,250 for £64 per share.

The snapshot below shows the recent activity in the company’s shares by the insiders.

LendInvest share price forecast

According to TipRanks’ analyst consensus, LendInvest stock has a Moderate Buy rating. This is based on a Buy rating from analyst Alexander Bowers from Berenberg Bank, who is bullish on the stock with a target price of 150p.

It implies an upside potential of 80% on the current price level.

Conclusion

Selecting the perfect stock for a portfolio requires not only macro and micro-level information. It also depends on how fast you can get that information to plan your next move.

This recent buying of shares by insiders reflects their confidence in the company’s fundamentals. These activities can guide investors to choose the shares along with other parameters.