The rise of the new Omicron variant has indicated the pandemic is an ongoing concern, suggesting newcomers to the Covid-19 vaccine space could still have a significant role to play in battling the coronavirus.

However, it looks like it might be a while still until late entrant Ocugen (OCGN) will be able to play its part.

Last week, the company announced that its investigational new drug (IND) application for Covaxin – the Covid-19 vaccine the company has licensed from India-based Bharat Biotech – has been put on clinical hold by the FDA.

Therefore, Ocugen will be unable to progress with the bridging study intended to compare US patients’ response to the vaccine with those from the Indian Phase 3 trial. The company said the FDA has yet to provide it with the reasons behind the halt and what it must do to address any issues.

“Based on previous cases,” said Noble analyst Robert LeBoyer, “We believe the FDA could be taking extra precautions due to public health concerns and political considerations related to the COVID-19 pandemic.”

While the FDA’s decision pushes back the study’s initiation, the analyst sees no implications for Covaxin. “Our timeframes for the US approval were based on conservative timeframes, slow regulatory action, and small initial market share,” LeBoyer went on to say.

The analyst also notes that as the trial has yet to begin, the term “Clincal Hold” here only refers to the IND approval’s delay and should not be confused with a Clincal Hold issued mid-trial due to adverse events or safety issues.

Covid vaccine prospects aside, Ocugen has another IND it plans on filing, for the first product from its gene therapy technology platform – OCU410 is indicated to treat dry age-related macular degeneration (dry AMD). While Covaxin has caught investors’ attention, LeBoyer continues to view the gene therapy platform as a “strong long-term technology in development by the company.”

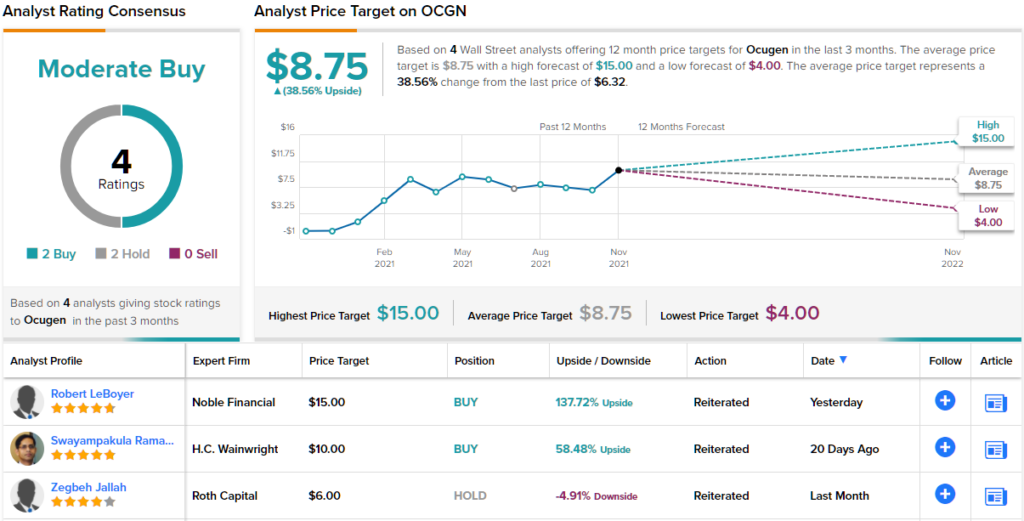

Overall, LeBoyer stays with the bulls, reiterating an Outperform (i.e. Buy) rating and $15 price target on OCGN shares. Investors are looking at upside of a hefty 137% from current levels. (To watch LeBoyer’s track record, click here)

Granted, not everyone is as enthusiastic about Ocugen as LeBoyer. Wall Street is split down the middle on this one, with the stock’s Moderate Buy consensus rating based on 2 Buys and Holds, each. Where the price target is concerned, the bulls are in full control; at $8.75, the figure suggest shares will be changing hands for ~39% premium a year from now. (See Ocugen stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.