Competition for top dog billing in the Covid-19 vaccine space has basically turned into a two-horse race. So far, Pfizer (PFE)/BioNTech (BNTX) lead the way, but Moderna (MRNA) has provided the stiffest competition. The latter vaccine maker has built its fortune on the success of its offering mRNA-1273 (Spikevax) and will attempt to get one over Pfizer/BioNTech’s product by being the first vaccine authorized for use in children under 6yrs old.

Interim data from the KidCOVE trial showed that the one-quarter sized two-dose series resulted in a level of virus-blocking antibodies similar to that as the standard vaccine exhibited in adults age 18-25.

In children aged 6 months to under 2 years, the vaccine showed an efficacy rate of 43.7% against omicron. In the older age group, the vaccine displayed efficacy of 37.5%. As there were no severe cases in the study, its efficacy against severe disease could not be evaluated.

Based on the speed of past authorizations, Cowen analyst Tyler Van Buren says the data could lead to a US EUA “expansion” around April.

Pfizer/BioNTech’s three-dose data are anticipated in April, and if positive, that could lead to an EUA extension around May. So, Moderna could get a head start on its competitor but how significant could that ultimately be?

Van Buren thinks there could be a “small incremental advantage” though that is unlikely to change the overall revenue outlook for the year.

In some states (New York, Vermont), where vaccine uptake in older children has been robust (over 80% in 5-11 age group), Van Buren thinks that in the month prior to Pfizer’s May entry, there could be “millions of doses administered.”

But vaccine uptake for children across the US has generally been poor – less than 20% – and Van Buren expects demand to “level off quickly.”

“As a result,” the analyst summed up, “we believe that most high-income countries have already accounted for a surplus of doses that should cover minors in existing or planned agreements, and these age expansions shouldn’t impact revenue significantly in the near term.”

For now, the analyst remains on the sidelines with a Market Perform (i.e. Hold) rating, although his $200 price target could still generate returns of ~21% over the coming months. (To watch Zhu’s track record, click here)

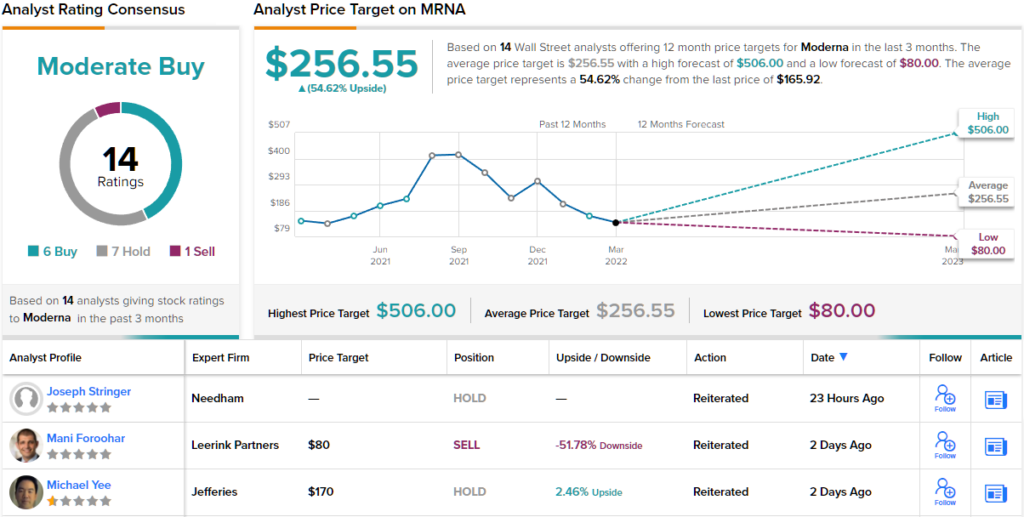

Looking at the consensus breakdown, based on 6 Buys, 7 Holds and 1 Sell, the analysts rate this name a Moderate Buy. The average price target is more bullish than Van Buren will allow; at $256.55, the figure indicates gains of ~55% could be in the cards over the next year. (See Moderna stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.