CoreWeave shares slipped after reports of a data center build delay, though analysts kept a bullish view, calling the setback “temporary” and maintaining confidence in the company’s AI infrastructure growth.

CoreWeave Stock Falls on Build Delay; Analyst Keeps Buy Rating, Says Shortfall Is ‘Temporary’

Story Highlights

CoreWeave (CRWV) beat on revenue, missed less than feared on EPS, then dropped anyway. The stock fell after management said a third-party developer is behind on a data center build and 2025 revenue guidance of $5.05–$5.15 billion landed below the Street. The note that was informative came from Melius Research’s Ben Reitzes, who zeroed in on what broke and what likely fixes it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reitzes Frames the Dip as a Timing Issue

Reitzes told clients the demand story is intact and the gap is about construction timing, not customer appetite. He wrote: “We do expect the coming 2 quarters of shortfalls to be temporary and new demand can make up for it for full year 2026,” pointing investors to a recovery path tied to capacity arriving on time.

He kept a Buy rating while trimming the price target to $140 from $165, signaling conviction in the multiyear AI buildout even as near-term numbers reset.

Reitzes Flags Capacity Control as the Core Risk

The analyst said the schedule slip highlights an execution dependency on third-party developers. His read is blunt and actionable: “The issue does show that CoreWeave may need to have more control of data center capacity and engineering to make sure this doesn’t become an ongoing issue—so it seems likely to vertically integrate more in the future.”

This prescription changes up the debate from macro demand to company design. More owned or tightly controlled build capacity could smooth project timelines, reduce handoff risk and support steadier quarterly cadence.

CoreWeave’s Guidance Resets the Near-Term Bar

Management guided 2025 revenue below consensus, which explains the knee-jerk selloff. Investors now have a lower bar for the next few prints, and any evidence of faster site work or earlier rack deliveries can flip sentiment quickly.

On the call, CoreWeave said AI demand “far exceeds” available capacity. This backdrop supports the Melius view that pushed-out revenue is more deferral than loss.

Vertical Integration Could Be the Fix

If CoreWeave leans into owning more of the stack, investors should watch for moves in land, shells, power procurement and internal engineering. Each step increases control and can shorten time from order to live capacity.

Better control usually carries heavier capex and execution risk. The trade-off is a tighter grip on schedules, which the market tends to reward with higher confidence and tighter multiples.

Key Takeaway

To sum up, the drop in CRWV stock reflects a supply chain delay, not a demand crack, and the answer is more control over capacity with a tilt toward vertical integration. A steady Buy rating and confident target leave CoreWeave with a straightforward playbook. It must show the delay is short-term, boost capacity, and rely on 2026 to make up the slack.

Is CRWV Stock a Buy?

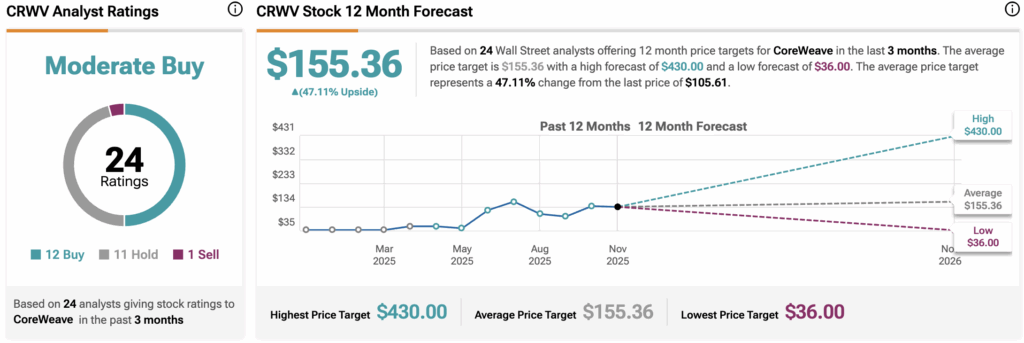

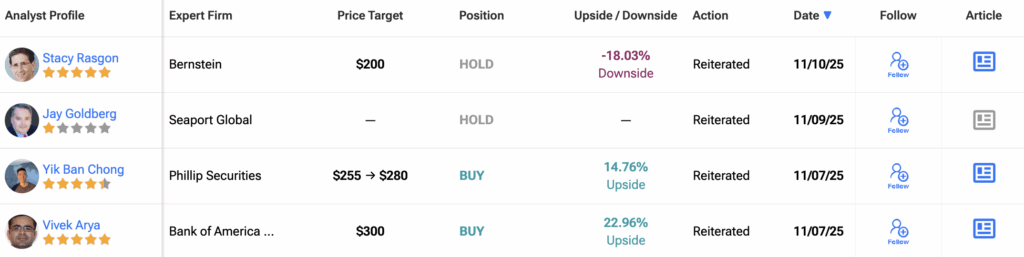

The stock of CoreWeave has a consensus Moderate Buy rating among 24 Wall Street analysts. That rating is based on 12 Buy, 11 Hold, and one Sell recommendation assigned in the last three months. The average CRWV price target of $155.36 implies 47.11% upside from current levels.

1