Magnetar Financial LLC, a majority shareholder (more than 10% owner) of CoreWeave (CRWV), sold approximately $177.23 million worth of common stock on September 25. This sale marks the firm’s eighth consecutive transaction of CRWV stock since the IPO lock-up period expired. The shares were indirectly held by several of Magnetar’s funds, including Magnetar Financial LLC, Magnetar Capital Partners LP, and Supernova Management LLC.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CoreWeave is a cloud infrastructure provider that delivers high-performance computing (HPC) solutions tailored for applications in artificial intelligence and blockchain.

A Closer Look at the Insider’s Transactions

According to two Form 4 filings with the SEC on September 26, Magnetar Financial sold 1,113,847 and 185,627 CRWV shares on September 25, totaling about $177 million. These shares were sold in multiple tranches at weighted average prices ranging between $133.79 and $138 apiece.

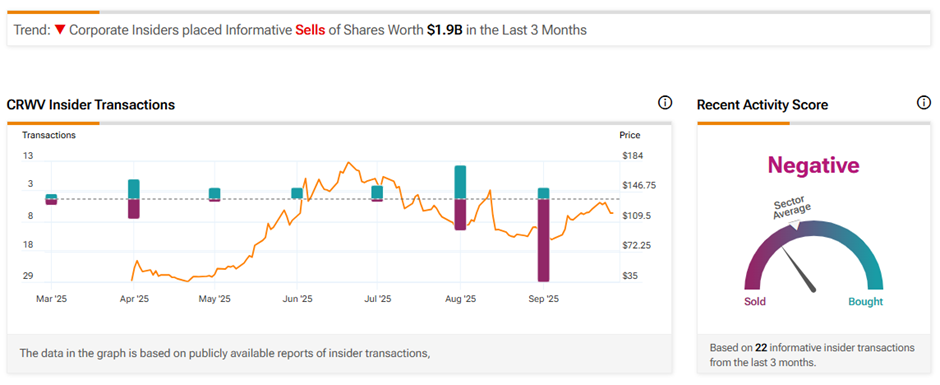

Currently, CRWV stock has a Negative Insider Confidence Signal on TipRanks, based on Informative Sell transactions exceeding $1.9 billion, undertaken in the last three months.

Should CoreWeave Retail Investors Worry?

Many CoreWeave IPO investors have offloaded nearly $2 billion in shares since mid-August, raising concerns among retail investors. Since its highly successful IPO in March 2025, the stock has surged nearly 225%. The stock’s rapid growth reflects strong demand for AI and GPU (Graphics Processing Unit) cloud services.

However, it remains a risky investment, and investors should consider their risk-reward profile. CRWV stock currently trades around $120, down from its 52-week high of $187, but it still shows a significant increase since the IPO.

Insider share sales usually indicate caution about a company’s future, but can also happen for personal reasons. Hence, it is important to watch these trades for clues on the company’s growth expectations.

Is CRWV a Buy, Hold, or Sell?

On TipRanks, CRWV stock has a Moderate Buy consensus rating based on 15 Buys, 11 Holds, and two Sell ratings. The average CoreWeave price target of $145.31 implies 20.8% upside potential from current levels.