Australia’s Core Lithium (ASX:CXO) shares soared around 6% just before midday, jumping after the company announced the official opening of its Finniss mine in the Northern Territory.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Core’s Finniss project is the Northern Territory jurisdiction’s first lithium mine in production. The company aims export of lithium ore from the mine by the end of 2022. Core has already secured supply contracts from customers for about 80% of the Finniss mine’s production for the first four years.

Strong lithium demand

Lithium is a central material in the manufacturing of batteries that power electric vehicles. Moreover, lithium batteries are used to store energy from renewable sources, such as solar and wind.

“Core is bringing production online at a time of high lithium prices, strong global demand and constrained supply,” stated Core Lithium’s CEO, Gareth Manderson.

Core Lithium share price prediction

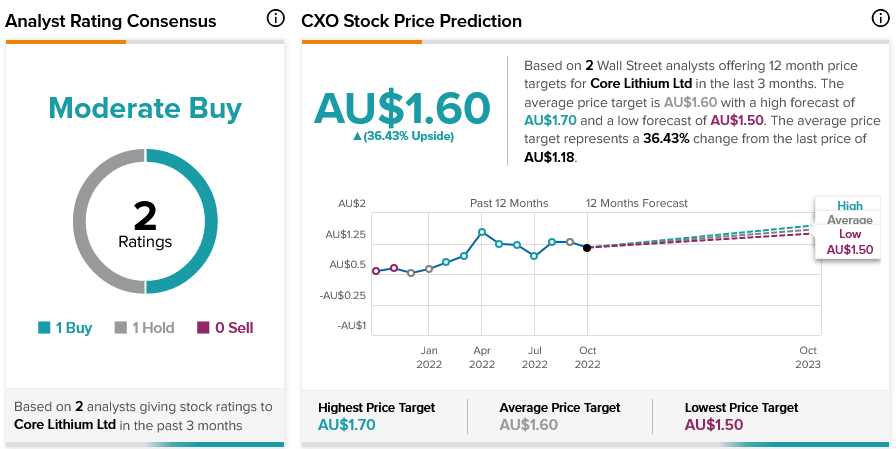

According to TipRanks’ analyst rating consensus, Core Lithium stock is a Moderate Buy. The average Core Lithium share price prediction of AU$1.60 implies about 36% upside potential.

Core Lithium stock scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Closing thoughts

The demand for lithium is forecast to increase amid the global shift to electric vehicles and renewable energy. As a result, Core Lithium has the opportunity to capitalise on the strong predicted market growth.