The Sprott Junior Copper Miners ETF (NASDAQ:COPJ) looks attractive, as copper prices recently broke through the $10,000 per ton level for the first time in two years. To be clear, this ETF is not for the faint of heart, as it invests in shares of high-risk, high-reward junior copper miners. It also comes with a hefty price tag in terms of fees and has just $9.4 million in assets under management (AUM). Nonetheless, I’m bullish on COPJ and believe that now could be a good time to invest in junior copper miners.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The COPJ ETF should enable investors to capture plenty of potential upside if copper prices continue to stay higher for longer, which looks like a good long-term bet based on increasing demand and persistent supply constraints.

What Is the COPJ ETF’s Strategy?

According to fund sponsor Sprott, a firm that specializes in the metals and mining space, COPJ invests in an index “designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses.”

Sprott explains that COPJ is “the only pure-play ETF focused on small copper miners,” giving investors exposure to companies “with the potential for significant revenue and asset growth.”

Sprott also points out that copper is an attractive commodity over the long term, as it is crucial to the global transition towards renewable energy. That’s because the metal is a critical component for electric vehicles as well as for wind and solar energy. Sprott stated, “To meet net-zero carbon emissions targets, energy transition-related demand for this critical mineral may increase nearly 4 times by 2040, relative to 2022.”

The long-term demand picture for copper looks compelling, and the bull case for copper is further bolstered by the likelihood of long-term supply constraints.

Bloomberg said there is growing speculation that “the world’s mines will struggle to meet a coming wave of demand from green industries” and that this speculation is fueling copper’s rally. Bloomberg also warned, “A historic squeeze on the supply of mined ores risks tilting the market into a major deficit and as investors turn increasingly optimistic about demand.”

Over the long term, massive amounts of new supply will need to come online to meet the demand for renewable energy, the growing number of electric vehicles, and the world’s growing power grid. Olivia Markham, co-manager of the BlackRock (NYSE:BLK) World Mining Trust, recently explained that copper prices would need to hit $12,000 per ton in order to catalyze investment in the new mines that will be needed to prevent copper deficits in the future.

Furthermore, mining giant BHP Group’s (NYSE:BHP) bid to acquire fellow miner Anglo American (OTC:AAUKF) for a significant premium last week is seen as a bullish sign for copper and for the mining space as a whole.

Anglo American rejected BHP’s offer despite the fact that it represented a 31% premium to the company’s valuation, and pundits expect that a bidding war for the company could ensue. BHP and Anglo American are both significant producers of copper. The proposed acquisition indicates that the shares of these miners are attractive and that big miners are willing to pay a premium to acquire more capacity, which could benefit junior miners like the ones COPJ owns, in particular.

The companies that COPJ owns appear well-positioned to take advantage of this long-term supply and demand dynamic, as these companies, which are “upstream in the supply chain,” in particular, could benefit as increased demand creates the need for new mines.

COPJ’s Holdings

COPJ holds 42 stocks, and its top 10 holdings account for 57.4% of assets. You’ll find an overview of COPJ’s top 10 holdings below using TipRanks’ holdings tool.

Sprott classifies 58.5% of the copper mining stocks that COPJ invests in as small-caps — ones with market caps of below $2 billion. The remaining 41.5% of the fund is invested in what it defines as medium-cap companies — those with market caps between $2 billion and $10 billion.

Therefore, you won’t find any mining giants like BHP or Anglo American among its holdings, but you’ll find plenty of smaller upstream exploration and production companies that could stand to benefit handsomely as demand for new mines comes online. A word to the wise is that while these stocks offer the potential for significant rewards, they are also higher-risk investments due to their smaller market caps and less-diversified operations.

COPJ offers U.S. investors substantial geographic diversification. Canada accounts for the fund’s largest exposure with a weighting of 55.4%, and Canada is followed by Australia, which has a weighting of 21.6%. Countries including Peru, Cyprus, and the Philippines are also represented in the fund. The U.S. makes up just a 2.7% weighting within the fund.

Beware of COPJ’s High Expense Ratio

One word of warning that investors need to be aware of is that COPJ has a fairly high expense ratio of 0.75%. This means that an investor in the ETF will pay $75 in fees on an annual basis for every $10,000 invested. This high expense ratio is somewhat unsurprising, given that COPJ is a small fund with just a minuscule $9.4 million in assets under management and because it invests in many obscure, smaller international stocks.

If copper prices continue to rise and the stocks that COPJ owns surge, then this high expense ratio will be water under the bridge for many investors. But if the thesis doesn’t play out and the fund performs poorly, the high expense ratio could end up being particularly unpalatable.

Does COPJ Pay a Dividend?

COPJ is a dividend payer. The fund currently yields 2.0%, which is higher than the S&P 500’s (SPX) yield of 1.4%.

Is COPJ Stock a Buy, According to Analysts?

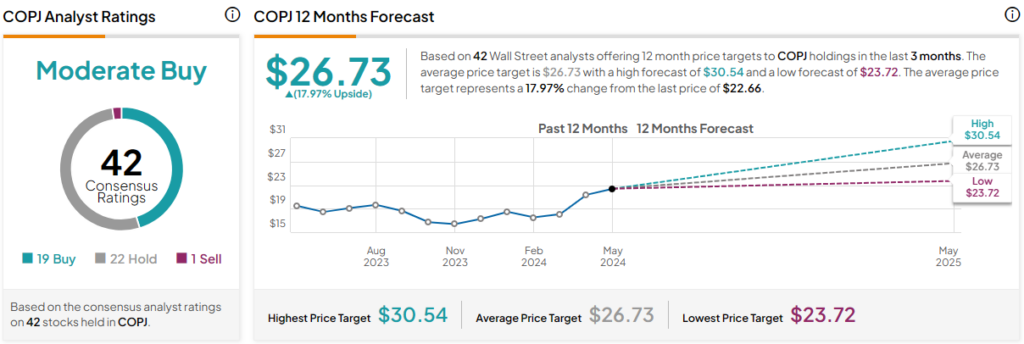

Turning to Wall Street, COPJ earns a Moderate Buy consensus rating based on 19 Buys, 22 Holds, and one Sell rating assigned in the past three months. The average COPJ stock price target of $26.73 implies 18% upside potential.

Conclusion: Attractive, But Not for the Faint of Heart

Given the long-term supply and demand trends for copper, I’m bullish on COPJ, as it looks like an attractive investment opportunity over the long term.

As the copper supply will need to increase to keep up with growing demand from EVs, renewable energy, and other industries, new capacity will need to come online which should benefit the types of upstream copper companies that COPJ owns.

With copper soaring past $10,000 for the first time in two years, both the short term and long term look compelling for COPJ and its holdings. BHP’s bid for Anglo American shows that there is plenty of potential for stocks in this space to move higher and no shortage of appetite to increase capacity.

However, this is clearly a high-risk, high-reward investment that is not for the faint of heart. Many of these are small-cap stocks that can be particularly volatile, and the fund itself has just $8.6 million in AUM and a high expense ratio. That being said, I feel that the long-term potential for the space makes the risk worth the reward.