How is the consumer doing these days? Well, anecdotally, we can say the answer is “not well” because gas prices are on an upward tear once more as summer blend starts kicking in, and bird flu purges turn eggs into unobtainium once more. A new look from Wells Fargo (NYSE:WFC), meanwhile, suggests little good, and, as a result, consumer stocks are mixed in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

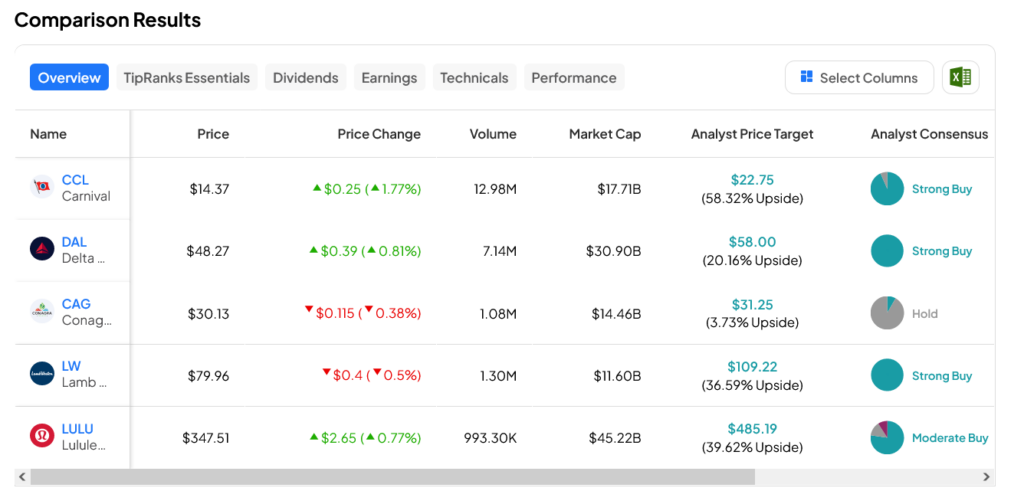

Conagra (NYSE:CAG) and Lamb-Weston (NYSE:LW) were both down fractionally, but both Delta Air Lines (NYSE:DAL) and Lululemon (NASDAQ:LULU) gained fractionally. Carnival Cruise Lines (NYSE:CCL) proved the winner of the day, up nearly 2% in the session.

There is a rising concern about overall consumer sentiment, and not without reason. But for the stocks Wells Fargo’s equity research team analyzed, attributed to no single analyst, the results were somewhat surprising. Demand for most consumer issues is on the decline. However, there is still some life in the high-end consumer market, which is to be expected. The high-end consumer is generally the least sensitive to economic movement by virtue of their greater liquidity.

The stocks in question, meanwhile, found themselves often battered by conditions. For Lamb-Weston and Conagra, there were trade-downs in play. In fact, Lamb-Weston found that global demand for french fries is down below the historical growth rate of 2% to 4%. But travel—as evidenced by Delta and Carnival—was still a clear top priority for consumers.

Retail Rising

One point that gave consumers an edge was retail. March’s retail report beat expectations, noted a report from the Census Bureau. Food and retail goods sales were up 0.7%, which was well above the 0.3% gain expected. However, both car dealerships and furniture stores took hits for the month, and high interest rates were generally cited as a reason why.

This has some worried about when rate cuts will show up at the Federal Reserve; a cut in rates might stir up inflation even further, though other signs suggest that the consumer is running out of ammunition in the face of soaring costs.

Which Consumer Stocks Are Good Buys Right Now?

The leader in today’s trading was CCL stock. With an average price target of $22.75 per share, this Strong-Buy-rated stock offers investors 58.32% upside potential. The laggard, meanwhile, is CAG stock. Rated only a Hold, it can produce only a meager 3.73% upside potential against its average price target of $31.25 per share.