Constellation Brands (NYSE: STZ) generated revenues of $2.66 billion in Q2, up 12% year-over-year, surpassing Street estimates by $150 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company which owns the iconic beer brand Corona reported adjusted earnings of $3.17 per share in the second quarter versus $2.38 in the same period last year. Analysts were expecting earnings of $2.82 per share in the second quarter.

Constellation also updated its FY23 earnings outlook to be in the range of $0.75 to $1.15 per share. The company also affirmed its FY23 operating cash flow target between $2.6 billion and $2.8 billion and free cash flow projection in the range of $1.3 billion to $1.4 billion.

Is Constellation Brands Stock a Buy?

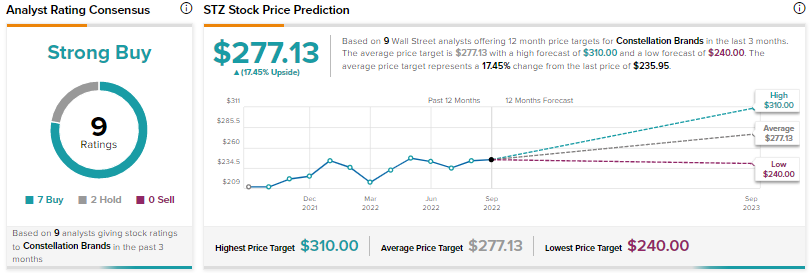

Wall Street analysts rate STZ as a resounding Buy with a Strong Buy consensus rating based on seven Buys and two Holds.

The average price forecast for STZ stock is $277.13 implying an upside potential of 17.5% at current levels.