Constellation Brands, Inc. (NYSE:STZ) is scheduled to release its third quarter Fiscal 2023 results on January 5, before the market opens. High demand for alcohol during the holiday season along with the introduction of non-alcoholic drinks might have supported the company’s quarterly performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in New York, Constellation Brands is one of the world’s largest producers and distributors of beer, wine, and spirits.

Furthermore, as per the data released by NielsenIQ, the 2022 World Cup tournament led to a 3.1% year-over-year rise in beer sales. Also, Constellation is expected to have benefitted from selling some of the most preferred high-end beverages, including Modelo Especial, Corona Extra, Pacifico, and Meiomi, which continue to dominate the market.

However, persistently high inflation leading to increased costs of raw materials, transportation, and labor may have impacted the company’s bottom line.

The Street expects Constellation Brands to post adjusted earnings of $2.91 per share in Q3, lower than the prior-year period’s figure of $3.12 per share. Meanwhile, revenue expectations are pegged at $2.4 billion, representing a year-over-year jump of 4.3%.

Is Constellation Brands Stock a Buy?

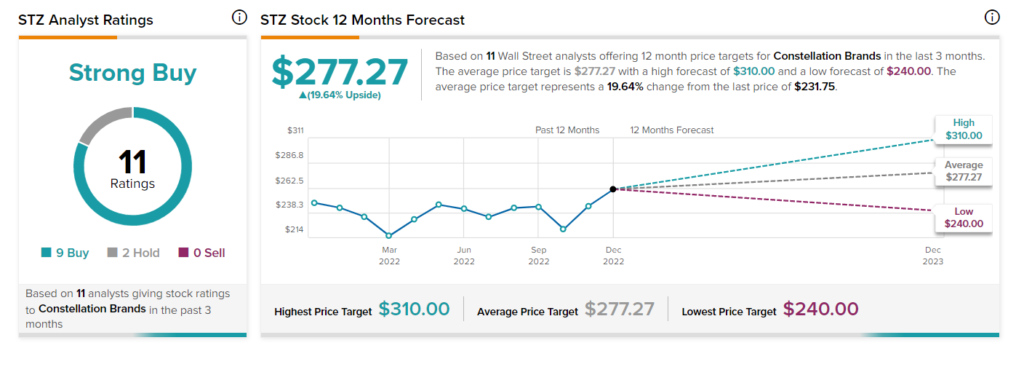

Wall Street is highly optimistic about the stock. STZ has a Strong Buy consensus rating based on nine Buys and two Holds. The average stock price target of $277.27 implies 19.6% upside potential from current levels.

Ending Thoughts

The expansion of Constellation Brands’ brewing capacity, along with a focus on growing its international presence, is expected to support the company’s performance. Also, investments in the promotion of its products continue to attract customers.