Shares of alcoholic beverage provider Constellation Brands (NYSE:STZ) are in the green today after the company delivered an earnings beat for the fourth quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue declined 4.8% year-over-year to $2 billion, missing the cut by $20 million. EPS at $2.15, on the other hand, came in ahead of expectations by $0.32. During the quarter, the company’s Modelo Especial and Corona brands witnessed continued strength. In the Wine and Spirits segment, higher-end brands saw strong increases. Additionally, its DTC channels witnessed a 35% growth.

Looking ahead, for fiscal 2024, STZ sees EPS landing between $11.60 and $11.90. During the year, Beer net sales are anticipated to grow in the 7% to 9% range. Organic sales of Wine and Spirits though are expected to hover between a 0.5% growth to a 0.5% decline.

Additionally, the company has also bumped up its dividend by about 11% to $0.89 per share. The dividend is payable on May 18 to investors of record on May 4.

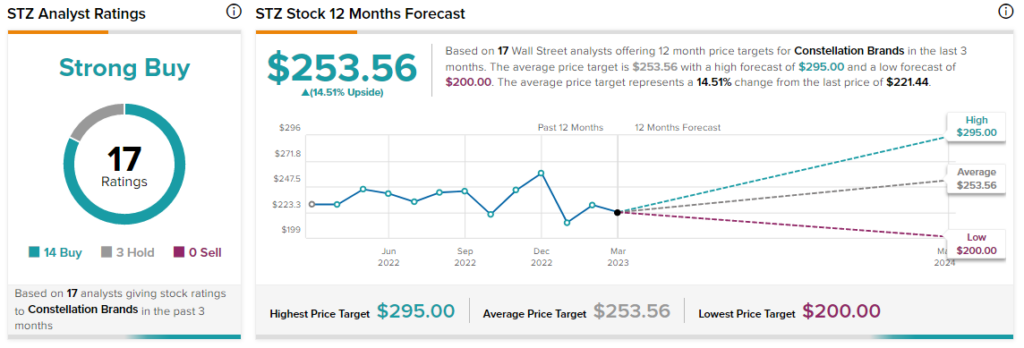

Overall, the Street has a $253.56 consensus price target on STZ pointing to a 14.5% potential upside in the stock. That’s after a 6% slide in the share price over the past six months.

Read full Disclosure