Shares of Palantir (NYSE:PLTR) gained over 27% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.05, which beat analysts’ consensus estimate of $0.04 per share. Sales increased by 17.8% year-over-year, with revenue hitting $525.19 million. This beat analysts’ expectations of $505.94 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Palantir’s segments all featured substantial growth. Its U.S. revenue, for example, reached $337 million, a 23% jump against this time last year. Commercial revenue worldwide, meanwhile, added 15% year-over-year to reach $236 million. Worldwide government revenue hit $230 million, which was up 22%. Even Palantir’s customer counts were substantially higher, growing 41% year-over-year and 7% just since last quarter.

Further, Palantir management offered some future projections. Palantir expects revenue to come in between $528 million and $532 million, faltering against consensus estimates looking for $536.2 million. For the full year 2023, things look slightly better; Palantir expects earnings between $2.185 billion and $2.235 billion, in line with expectations of $2.2 billion.

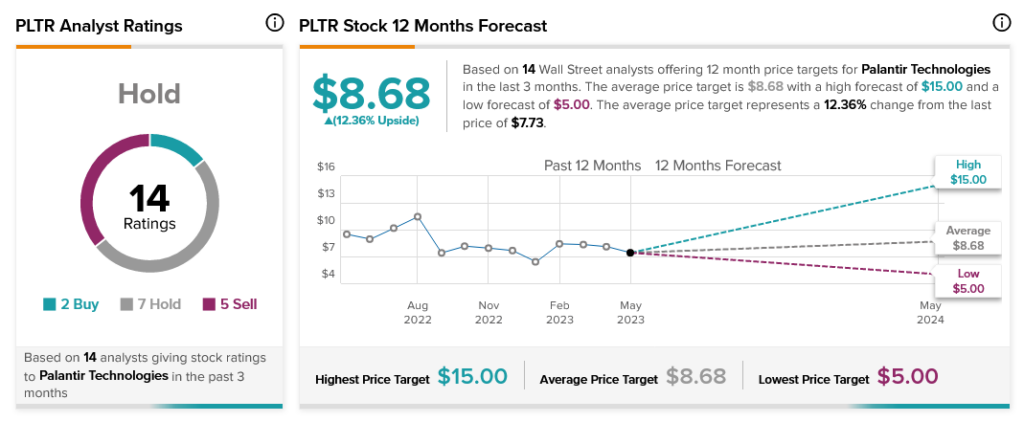

Overall, Wall Street has a consensus price target of $8.68 on Palantir stock, implying 12.36% upside potential, as indicated by the graphic above.