With all the recent trouble getting oil out of Russia and the Middle East, word about oil stock ConocoPhillips’ (NYSE:COP) plan to pull oil from a project in Alaska, known as the Willow oil project, should be welcome. It wasn’t to everybody, however, resulting in a court case. But that case has now been resolved, and ConocoPhillips shares gained just over 1.5% as a result.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Willow oil project, approved by the Biden Administration in something of a departure of type, represents around 600 million barrels of oil in Alaska’s North Slope region. It’s been valued at $7.5 billion, so it’s clear why ConocoPhillips was so eager to get to it.

But both environmentalists and indigenous groups wanted the project—which is located in the so-called “National Petroleum Reserve”—halted. The usual concerns were cited: issues of greenhouse gas production, as well as issues impacting the local seal and polar bear populations, among others. But the project went through, and ConocoPhillips plans to start construction this winter.

The judge in the case, U.S. District Court Judge Sharon Gleason, found that the available government analysis was in line with currently existing environmental law, as well as previously established goals for the National Petroleum Reserve. Gleason already issued something like permission for ConocoPhillips to start up, as back in April, ConocoPhillips could start building roads into the region. While indigenous groups and environmentalists were opposed, the Alaska State House was clearly on board, thanks to improved state budget projections as a result of the oil yield from Willow.

Is ConocoPhillips a Buy, Sell, or Hold?

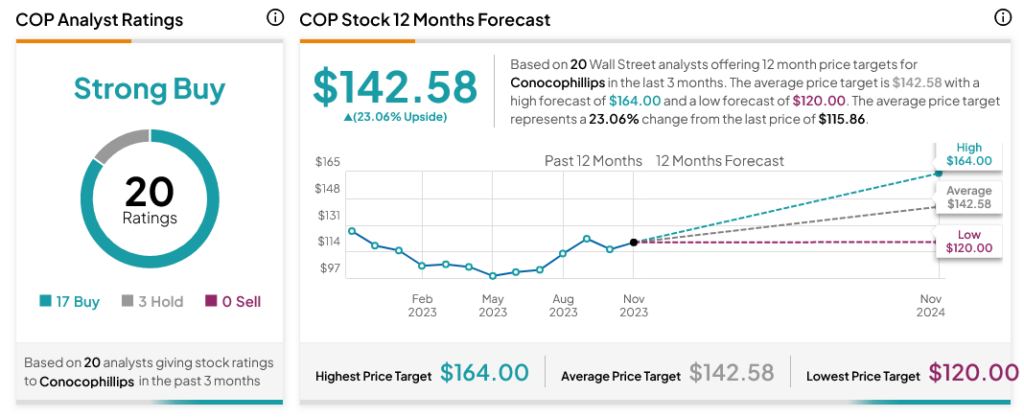

Turning to Wall Street, analysts have a Strong Buy consensus rating on COP stock based on 17 Buys and three Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average COP price target of $142.58 per share implies 23.06% upside potential.