Compounding pharmacies can be a big help for pharmaceutical companies like Novo Nordisk (NYSE:NVO). But sometimes, as Novo Nordisk found out, they can also do some harm. In fact, Novo Nordisk is leveling lawsuits at two such pharmacies over compounding issues, and it’s caused Novo Nordisk stock to slip fractionally in Thursday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The issue of compounding here is actually made doubly worse by considering all the circumstances involved and also explains why Novo Nordisk is pulling out all the legal stops to pursue said pharmacies. This time, the compounding focused on Wegovy, which is one of Novo Nordisk’s flagship products, a weight loss drug.

The lawsuits in question target Brooksville Pharmaceuticals and Wells Pharmacy, both in Florida, over matters that compounded Wegovy turned out to be impure. That may not sound like much, until you find out just how impure: as much as 33% off standard. Not only did the samples studied at Wells come back with a banned ingredient known as BPC-157, but the compounded drugs were also weaker by as much as 19%.

A Mixed Picture Overall

This news is somewhat mixed for Novo Nordisk. It’s likely going to have patients questioning whether the drugs they’re getting are similarly tainted, which could hurt the company and the stock. But Novo Nordisk’s rapid response should reassure the hesitant that their interests are being looked after, too. Meanwhile, we know that Novo Nordisk just came off some unpleasant comparisons between its weight loss drug and Eli Lilly’s (NYSE:LLY). However, Novo Nordisk recently managed to land a slot into the Hevolution Foundation’s incubator program, which will give it access to new resources to develop new drugs. For every bit of bad news hitting Novo Nordisk lately, there’s a bit of good news waiting in the wings.

What is the Future of Novo Nordisk Stock?

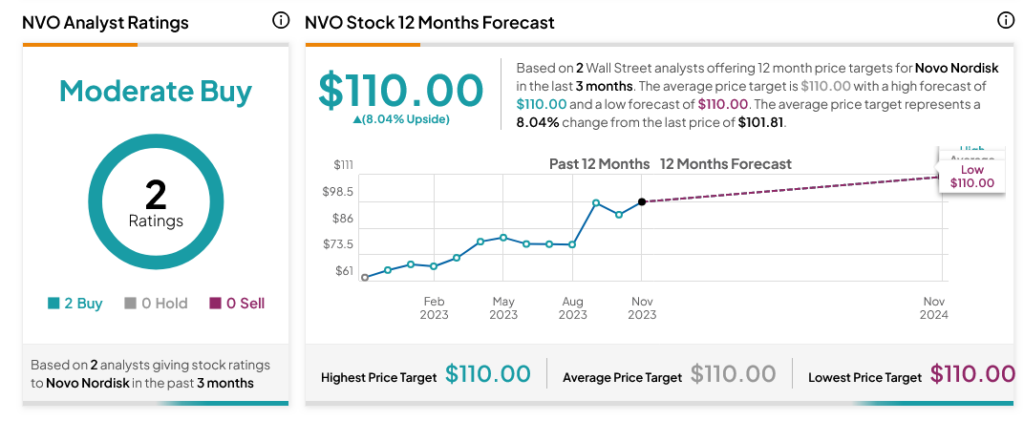

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NVO stock based on two Buys assigned in the past three months, as indicated by the graphic below. After a 62.85% rally in its share price over the past year, the average NVO price target of $110 per share implies 8.04% upside potential.