The Wall Street Journal, citing data from Jato Dynamics, reported that German automaker Volkswagen (XETRA:VOW)(VWAGY) is losing market share in China due to heightened competition from domestic players, including BYD Company (BYDDY).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Volkswagen’s recent delivery numbers in China (including Hong Kong) show an improvement. In October, Volkswagen delivered 263,400 vehicles in China, up 11.3% year-over-year. However, for the 10 months of 2022 (January to October), Volkswagen’s deliveries declined by 5.9%.

Excluding the Asia-Pacific region, Volkswagen’s deliveries declined in all other markets for the 10 months that ended in October 2022.

The Wall Street Journal report highlighted that Warren Buffet-backed automaker BYD has seen its market share double. Also, Nio (NYSE:NIO) and Xpeng (NYSE:XPEV) are popular among Chinese consumers.

Besides for competition, supply shortages and higher energy costs negatively impacted Volkswagen’s financials.

Is Volkswagen Stock a Buy, Sell, or Hold?

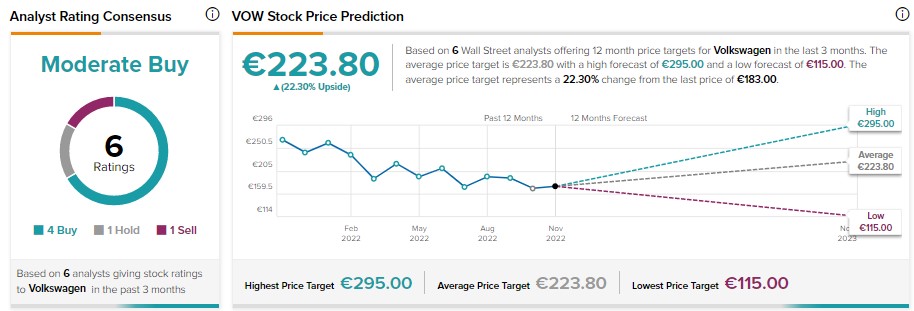

Volkswagen stock has a Moderate Buy consensus rating on TipRanks based on four Buy, one Hold, and one Sell recommendations. Furthermore, its price target of €223.80, implies 22.3%.

Meanwhile, Volkswagen stock has a Neutral Smart Score of six out of 10 on TipRanks.