Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Palantir Technologies (NASDAQ:PLTR) flew past expectations with its Q3 2025 earnings once more, giving plenty of support for CEO Alex Karp’s usual bullishness.

Palantir’s revenues grew to $1.2 billion, an astounding 63% higher than the previous quarter. Net profit grew to $476 million, also setting a company record and up 46% on a sequential basis.

A key metric for many, U.S. commercial growth more than doubled over the past year, reaching $397 million in revenues for Q3 – a 121% increase year-over-year.

“This ascent has confounded most financial analysts and the chattering class,” boasted Karp in his shareholder letter, tut-tutting those who would doubt PLTR’s continued successes.

While few are willing to question Palantir’s business performance, the sharp rise in the company’s share price makes many an investor a bit squeamish. It’s no secret that one of the biggest issues facing investors is PLTR’s sky-high valuation, especially after the share price has risen some 400% over the past twelve months.

That’s a significant stumbling block for top investor Jonathan Weber.

“Despite operational strength, PLTR’s high valuation—trading at 250x adjusted earnings—makes the stock risky,” explains the 5-star investor, who is among the top 2% of stock pros covered by TipRanks.

Weber is the first to acknowledge Palantir’s phenomenal quarter. Not only are revenues climbing, notes the investor, but the pace of growth is increasing. The 63% growth rate handily beat the 48% revenue surge in Q2, which wasn’t too shabby either.

“Operating with a high relative growth rate is always a good thing, but the fact that Palantir Technologies is experiencing an accelerating growth rate is even better,” adds Weber.

Moreover, the source of this growth was also a promising sign, and Weber terms the U.S. commercial revenue growth of 121% the “crown jewel” in Palantir’s Q3 earnings.

All told, Weber doesn’t have much of a bone to pick with Palantir’s operations, and the company is now guiding for adjusted income from operations in the range of $2.15 billion for the year.

It’s the valuation which remains problematic, details Weber, who cites an earnings multiple in the vicinity of 250x. That’s just too high for Weber, who cautions that this multiple will eventually contract.

“PLTR has been a great investment in the past, but at the current valuation, I’m staying on the sidelines,” sums up Weber, who is giving PLTR a Hold (i.e. Neutral) rating. (To watch Jonathan Weber’s track record, click here)

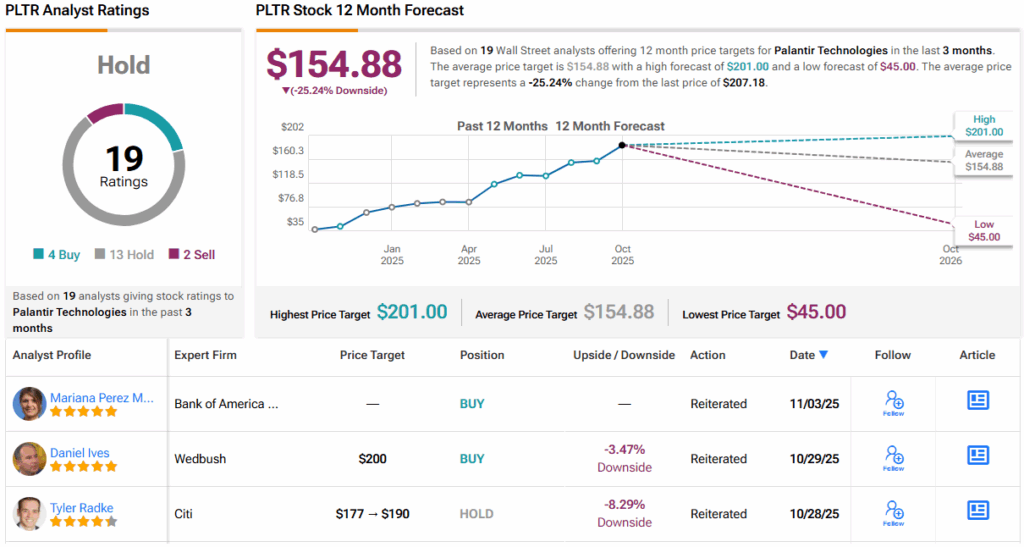

Despite the stellar report, Wall Street also finds itself sharing Weber’s cautious stance. With 13 Holds – to go along with 4 Buys and 2 Sells – PLTR carries a consensus Hold rating. Its 12-month average price target of $154.88 implies a downside of ~25%. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.