Media titans Comcast (NASDAQ:CMCSA) and Walt Disney (NYSE:DIS) have mutually agreed to fast-track negotiations for the sale of the remaining stake in Hulu until September 30. Comcast CEO Brian Roberts broke the news on September 6 at a conference. Disney controls the majority of the streaming service, with Comcast owning 33% of it. The earlier deadline for negotiations was January 2024.

Disney acquired Hulu’s streaming service as part of its purchase of 21st Century Fox’s entertainment assets in 2019. Under the original agreement, Hulu’s sale or purchase must carry a minimum valuation of $27.5 billion for the entire service. Notably, Hulu remains an attractive streaming service with 48.3 million subscribers as of July 1. As of now, Disney has not provided any official comment regarding the revised negotiation date.

Hulu Negotiations Could Turn Ugly

Roberts believes that Hulu’s current value exceeds $30 billion. However, Disney has already shown disagreement with the hefty valuation attached. The negotiations could be challenging and may take a long time to settle. Roberts insists that the negotiations should take into account offers from third parties to establish a fair valuation. He added that Comcast will use the sale proceeds to reward customers with share buybacks.

The sale of Hulu will include the entire content library available on the platform. For Disney, Hulu has acted as a catalyst for subscriber retention. Disney’s bundled subscription, which includes Hulu, Disney+, and ESPN+, is one of the hottest-selling packs since it is cheaper than buying individual subscriptions.

Entertainment companies are struggling to make profits with traditional TV channels seeing massive cord-cutting and subscriber declines in streaming services. Amidst the downturn, Hulu could attract potential third-party buyers too. In the most logical sense, the deal would involve Comcast selling the minority stake to Disney. But if negotiations turn ugly, it could also mean that both parties end up selling their stakes to a new buyer.

What is the Forecast for CMCSA Stock?

Wall Street remains cautiously optimistic about CMCSA’s trajectory. With 11 Buys and seven Hold ratings, Comcast stock has a Moderate Buy consensus rating. On TipRanks, the average Comcast price forecast of $50.06 implies 11.4% upside potential from current levels. Year-to-date, CMCSA stock has gained 28.2%.

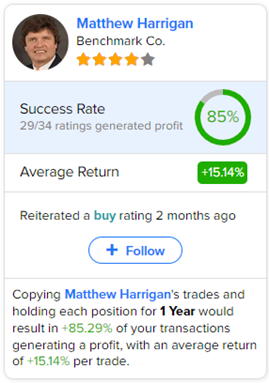

Moreover, investors looking for the most accurate analyst for CMCSA could follow Matthew Harrigan of Benchmark Co. Copying his trades on this stock and holding each position for one year could result in 85% of your transactions generating a profit, with an average return of 15.14% per trade.