Colgate-Palmolive reported better-than-expected 4Q results, reflecting strong consumer demand for its products amid the COVID-19 pandemic.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, shares of the consumer products company fell 1.5% on Friday after it said that “we expect high levels of uncertainty as we lap the benefits from pantry loading and other impacts of the COVID-19 pandemic. We also expect volatility in raw material and logistics costs and foreign exchange.”

Colgate-Palmolive’s (CL) 4Q earnings of $0.77 per share increased 5% year-over-year and topped analysts’ expectations by a penny. Sales grew 7.5% to $4.32 billion year-over-year and came in above the Street’s forecasts of $4.14 billion.

The company said that it maintained its global leadership in the toothpaste and manual toothbrush category with a market share of 39.8% and 31.1%, respectively, year-to-date. (See CL stock analysis on TipRanks)

For fiscal 2021, Colgate-Palmolive projects net sales to increase between 4% and 7% year-over-year. It forecasts adjusted EPS to grow in the mid-to-high single-digit range.

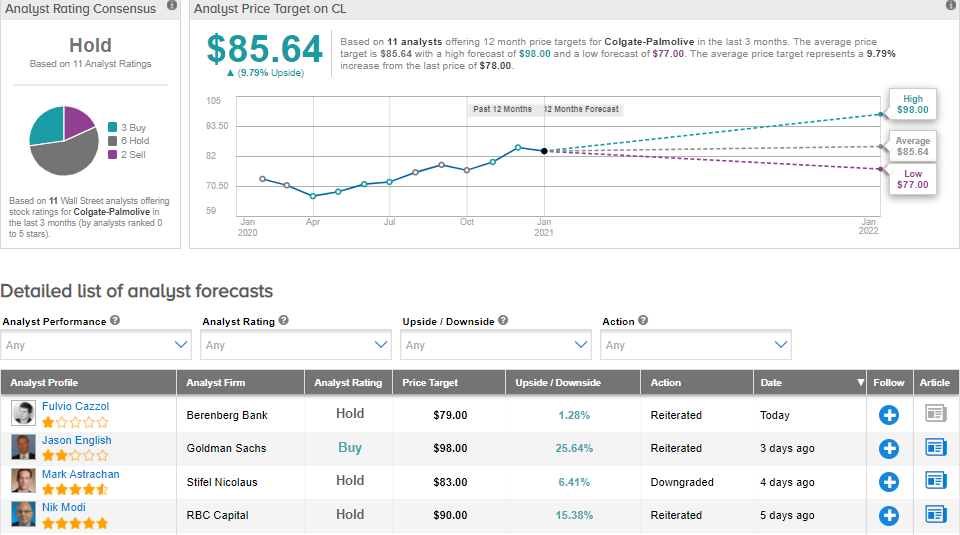

Ahead of its earnings release, Stifel Nicolaus analyst Mark Astrachan downgraded the stock to Hold from Buy and lowered the price target to $83 (6.4% upside potential) from $88.

In a note to investors, Astrachan wrote, “We think only modest near-term EPS upside coupled with valuation in line with historical averages relative to staples peers limits meaningful share price outperformance from current levels.”

Colgate-Palmolive scores a Hold consensus rating based on 6 Holds, 3 Buys, and 2 Sells. The average analyst price target of $85.64 implies upside potential of about 9.8% to current levels. Shares have gained 5.7% over the past year.

Related News:

Church & Dwight’s 4Q Profit Tops Analysts’ Estimates; Street Sees 14% Upside

Roper Technologies Dips 7% On 1Q Profit Outlook Miss

FB Financial Ramps Up Dividend By 22%