Coinbase Global (NASDAQ:COIN) is undertaking another headcount trim by slashing 20% of its jobs. This is the second instance of headcount reduction at the cryptocurrency trading platform in under a year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The development comes as economic conditions remain challenging, there is a series of implosions at major names in the crypto space (read FTX, Alameda, and BlockFi), and cryptocurrency prices are plunging.

The move is expected to result in restructuring costs in the range of $149 million and $163 million for the company.

Coinbase shares have now tanked nearly 83% over the past year and on top of this fall, short interest in the stock still remains high, at about 24%.

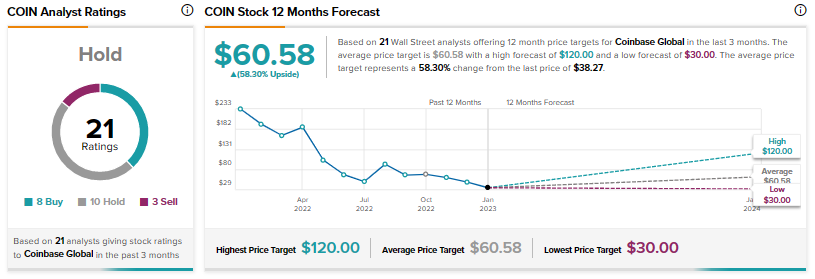

Analysts though, have assigned Coinbase shares a Hold consensus rating alongside an average price target of $60.58. This indicates a potential 58.3% upside in the stock.

Read full Disclosure