Coinbase (NASDAQ:COIN) just posted not only an earnings beat, but a big one that’s stunning the market and prompting a buying spree. I don’t usually like to chase a stock that recently ran higher, but I am bullish on COIN stock in light of Coinbase’s undeniably positive results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Headquartered in Delaware, Coinbase operates a popular cryptocurrency trading platform. The Securities and Exchange Commission (SEC) recently approved a number of spot Bitcoin (BTC-USD) exchange-traded funds (ETFs), and this watershed event seems to have boosted the market’s enthusiasm for Coinbase.

It really wasn’t very long ago when stock traders were worried about Coinbase because SEC Chairman Gary Gensler was apparently on the warpath against Coinbase. Today, the tide has turned, and crypto winter is changing into a new crypto spring. In other words, the pathway looks clear for COIN stock to embark on a bull run for the remainder of 2024.

Get Ready for a Slew of Coinbase Stock Upgrades

As we’ll discuss later, analysts haven’t been particularly bullish on Coinbase lately, and their ratings are generally lukewarm. Plus, their price targets haven’t reflected Coinbase’s growth potential. I fully expect this to change in the coming days and weeks, though, especially since Coinbase stock is up 9% today.

Don’t be surprised if analysts suddenly scramble to raise their COIN stock price targets and issue upgrades with lots of praise for Coinbase. This is to be expected now that Bitcoin is above $50,000 and multiple spot Bitcoin ETFs have been approved.

Not every analyst is late to the crypto party, though. I must give credit to Oppenheimer analyst Owen Lau, who was bullish on Coinbase in January, assigning the stock a Buy rating and a $160 price target (and he raised the price target to $200 today).

I fully agree with several of Lau’s positive points about Coinbase. The Oppenheimer analyst feels that “Spot Bitcoin ETF is a net positive” for Coinbase and that “COIN’s fundamentals are in upward trajectory” – and we’ll get to Coinbase’s fundamentals in a moment.

Additionally, Lau characterized Coinbase as a staunch survivor of the cryptocurrency market’s most challenging times. “The stock was under extreme scrutiny during crypto winter. While many peers went under, COIN is still standing and fighting for its businesses and the industry,” he observed, and I concur 100%.

Coinbase Thrills Investors with a Profitable Quarter

If COIN stock jumped today and the company was still unprofitable, then I would be worried. However, as it turns out, Coinbase just posted its first profitable quarter in two years.

It was a decent profit, too. Specifically, Coinbase earned $273 million in profits in 2023’s fourth quarter, which translates to earnings of $1.04 per share. This result is a powerful beat when compared to the consensus estimate of $0.02 per share.

Meanwhile, Coinbase’s Q4-2023 revenue climbed 51.6% year-over-year to $953.8 million. This result exceeded the consensus forecast by $135 million.

Looking ahead to the future, Coinbase’s management anticipates that the company will generate Subscription and Services revenue of $410 million to $480 million for the current quarter. This would represent substantial quarter-over-quarter growth over Coinbase’s fourth-quarter 2023 Subscription and Services revenue of $375 million.

Perhaps best of all, due to the company’s outstanding fourth-quarter performance, Coinbase managed to achieve a net profit of $95 million for the full year of 2023. Thus, the critics can’t point to Coinbase and call it a fly-by-night, highly speculative, unprofitable business. Clearly, Coinbase is legitimate and is here to stay.

Granted, Coinbase certainly benefited from the landscape-changing news of the SEC’s approval of spot Bitcoin ETFs. This event undoubtedly spurred an increase in Coinbase’s transaction revenue. Still, if you believe that more capital will flow into the cryptocurrency space, then it’s not a bad time to consider an investment in COIN stock.

Is COIN Stock a Buy, According to Analysts?

On TipRanks, COIN comes in as a Hold based on five Buys, four Holds, and six Sell ratings assigned by analysts in the past three months. The average Coinbase stock price target is $163.11, implying 10% downside potential.

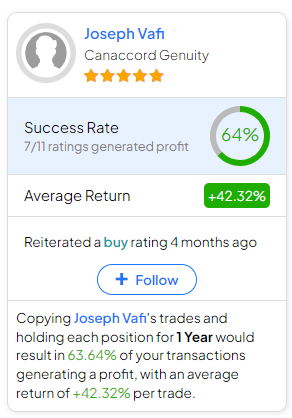

If you’re wondering which analyst you should follow if you want to buy and sell COIN stock, the most accurate analyst covering the stock (on a one-year timeframe) is Joseph Vafi of Canaccord Genuity, with an average return of 42.32% per rating and a 64% success rate. Click on the image below to learn more.

Conclusion: Should You Consider COIN Stock?

Lau was ahead of the curve with his positive assessment of Coinbase, and many other analysts will probably have to raise their price targets on Coinbase stock. They won’t be able to deny the momentum that’s building in the cryptocurrency space this year.

They also can’t overlook Coinbase’s impressive EPS beat and the fact that the company is profitable. Consequently, if you’re a crypto bull in general, it may be worth it to consider a share position in COIN stock.