Cryptocurrency stock Coinbase (NASDAQ:COIN) might be forgiven for wanting a little extra clarity on government rules that might well destroy it and its entire industry. But its request for that clarity didn’t turn out so well with the Securities and Exchange Commission (SEC). As a result, investors pulled back on Coinbase ownership, falling over 4% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The SEC, during an appeals court case, asked said court to reject the Coinbase petition that asked for cryptocurrency rulemaking clarifications. Why? Because apparently, the Coinbase petition came with no deadlines that would have required the SEC to take action. The SEC further noted that Coinbase couldn’t actually claim there was any “cognizable harm” done to Coinbase from the SEC not already acting on the petition.

Further, the language used in the filing by SEC lawyers noted that “Coinbase’s preference for faster or different regulatory action by the commission does not entitle it to extraordinary relief from this court.” Admittedly, that’s true, but it also doesn’t seem like Coinbase demanded any change in regulatory action. Rather, it just wanted to know what that regulatory action would actually be so they could plan ahead and get things ready without having to close large portions of their business first.

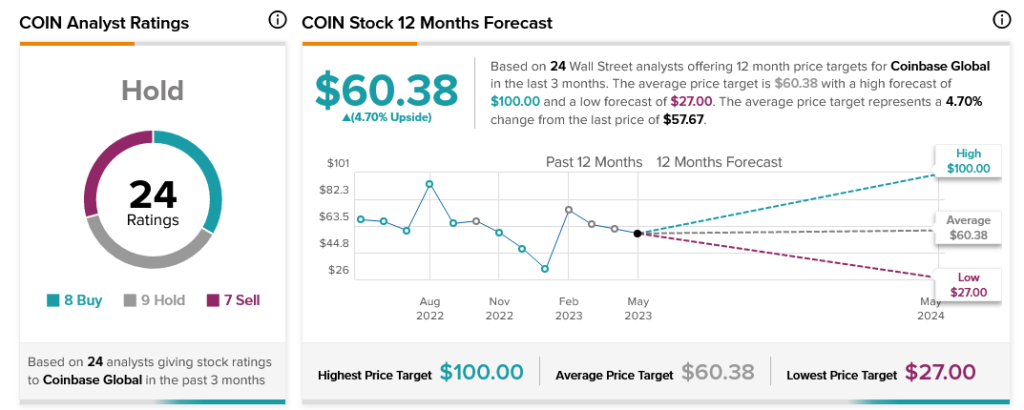

This leaves analysts at something of an impasse. A near-perfect mix leaves consensus flat-footed; eight Buy, nine Hold, and seven Sell ratings add up to an overall Hold for Coinbase stock. Further, with an average price target of $60.38, it also offers investors a slim 4.7% upside potential.