The biggest cryptocurrency exchange in the United States, Coinbase Global (NASDAQ:COIN), has partnered with American infrastructure company Transaction Network Services (TNS). The companies have joined forces to improve the speed and effectiveness of the Coinbase Derivatives Exchange (CDE).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CDE is a derivatives exchange platform authorized by the Commodity Futures Trading Commission that offers micro and nano futures instruments. The company launched the platform in mid-2022 to attract more retail customers.

TNS will deploy a cloud-based financial trading solution to CDE infrastructure located in Secaucus, NJ, and Aurora, IL. As a result, users will witness faster trade execution, increased storage capacity, and efficiency in processing large data sets.

Is COIN a Good Stock to Buy?

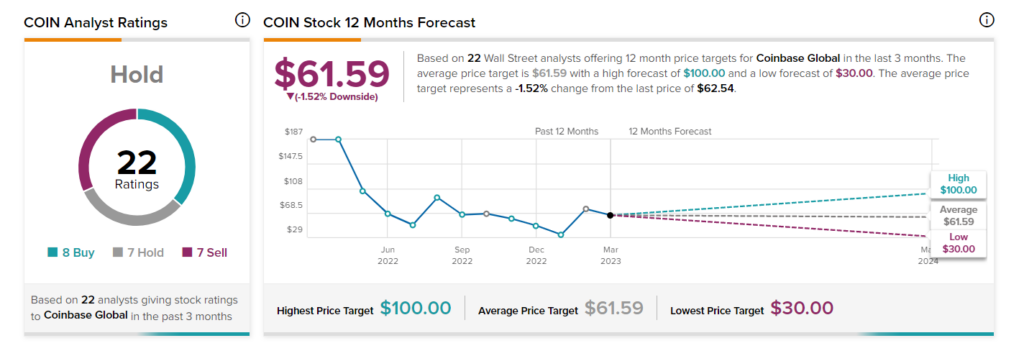

Turning to Wall Street, analysts seem to have mixed feelings about COIN stock. It has a Hold consensus rating based on eight Buys, seven Holds, and seven Sells. The average WBA price target of $61.59 implies 1.5% upside potential. Shares of the company have gained about 86% so far in 2023.