Leading cryptocurrency exchange Coinbase (NASDAQ:COIN) will now allow customers in Singapore to move funds to and from their Coinbase account using any local bank. The transfers in Singapore dollars will be facilitated by Standard Chartered (SCBFF) and will carry no fee.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Until now, Coinbase customers in Singapore were allowed to buy crypto through a Visa or Mastercard debit or credit card, or transfer crypto in and out of their Coinbase account. The company believes that the new capability will give customers more flexibility and control over their assets, by allowing them to cash in or cash out of their Coinbase accounts using bank transfers.

Coinbase also upgraded its help center to assist customers with various tools, like live chat.

Coinbase is introducing new solutions across several markets as part of its international expansion plans over the next eight weeks. It is trying to attract more customers to its platform at a time when investors are wary about the crypto market due to the collapse of several prominent players since the FTX debacle.

With regard to the latest crypto calamity – Silvergate Capital (SI), Coinbase recently clarified that it has “no material exposure.” However, Coinbase has about $240 million in deposits with Signature Bank (SBNY), which became the second bank to be closed this month by regulators after Silicon Valley Bank. Coinbase assured investors that it expects to recover these funds.

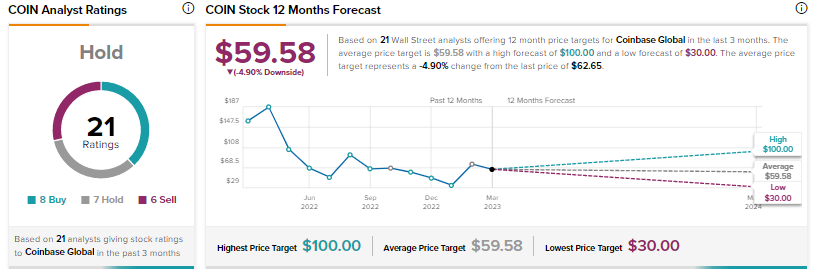

Is Coinbase a Buy or Sell?

Wall Street is sidelined on Coinbase, with a Hold consensus rating based on eight Buys, seven Holds, and six Sells. The average COIN stock price target of $59.68 indicates a possible downside of nearly 5% following a 77% year-to-date surge in the stock.