It was only two weeks ago that analysts were taking the notion of Bitcoin (BTC-USD) rising to $150,000 per coin with an increased seriousness. And now, a recent court win for Grayscale Bitcoin Trust (OTC:GBTC) is giving cryptocurrency stock Coinbase (NASDAQ:COIN) new life in Tuesday afternoon’s trading as well, with Coinbase up nearly 14% and Grayscale Bitcoin up nearly 18%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The win for Grayscale Investments, which handles the Grayscale Bitcoin Trust, came when a federal court required the Securities and Exchange Commission to vacate a ruling that kept the Grayscale Bitcoin Trust from making the shift into an exchange-traded fund (ETF). The SEC attempted to shut down the shift, fearing that a Bitcoin-based ETF would find itself easy prey for manipulation, but the U.S. District of Columbia Court of Appeals begged to differ. The SEC, the court said, failed to “adequately explain” why it had previously approved of two ETPs that traded in Bitcoin futures but not Grayscale’s plan to do the exact same thing.

While Coinbase also surged along with Grayscale—albeit not so hard—analysts already suggested that the surge for Coinbase was largely reactionary coupled with a bit of short-covering. Mizuho Securities’ Dan Dolev explained as much, calling the move a “…knee-jerk reaction and short covering….” However, Dolev also suggested that the Grayscale suit may give Coinbase fodder for its own legal battles with the SEC, serving as a vital precedent to derail those troubles before they can hit.

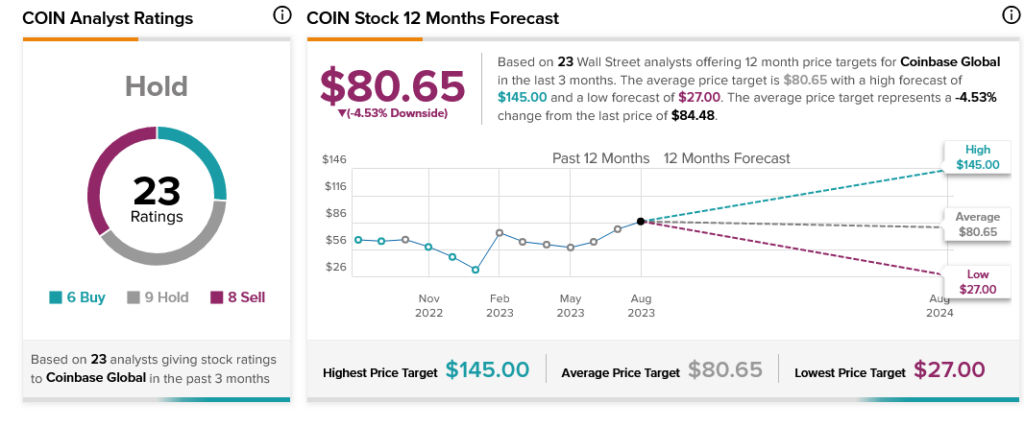

Coinbase needed a win like this, as analysts find themselves split over its likely future. With six Buy ratings, nine Holds, and eight Sells, Coinbase is currently considered a Hold by analyst consensus. Further, with an average price target of $80.65 per share, Coinbase can only offer its investors 4.53% downside risk.