Coinbase Global (NASDAQ:COIN) stock was down 1.6% in Tuesday’s pre-market trading. The crypto exchange was downgraded by Citigroup analyst Peter Christiansen to a Hold from Buy in Monday’s after-trading hours, as he believes that the stock will remain weighed down by a “high level of uncertainty” on the regulatory front. Further, Bloomberg reported that an investor sued Coinbase insiders, alleging that they dumped the stock within days of its public listing two years ago to avoid $1 billion in losses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citi’s Christiansen lowered the price target for COIN shares to $65 from $80. The analyst continues to believe that Coinbase is a category leader and one of the “better positioned” crypto platforms if broader integration with traditional finance happens. However, he contends that “Coinbase is now tasked to advocate for a reputationally damaged industry and pave a sustainable pathway towards regulatory compliance.”

Christiansen prefers to remain on the sidelines until there is more clarity about the regulatory rules in the U.S. market. Coinbase recently responded strongly to SEC’s Wells Notice.

Coming to the lawsuit, investor Adam Grabski alleged that Coinbase board used direct listing instead of the conventional initial public offering (IPO) and quickly sold shares worth $2.9 billion before management later revealed material, negative information that impacted market optimism from the company’s first quarterly earnings release. Within five weeks, shares plunged over $1 billion in value, noted Grabski, who has held COIN shares since April 2021.

The investor’s complaint, which includes Coinbase Chairman and CEO Brian Armstrong, director Marc Andreessen, and other executives as well as board members, demands the return of “ill-gotten gains.”

In an emailed statement to Bloomberg, Coinbase called the investor’s allegations meritless and said, “As the most popular and only publicly traded crypto exchange in the U.S., we are at times the target of frivolous litigation.”

Is Coinbase a Buy, Hold, or Sell?

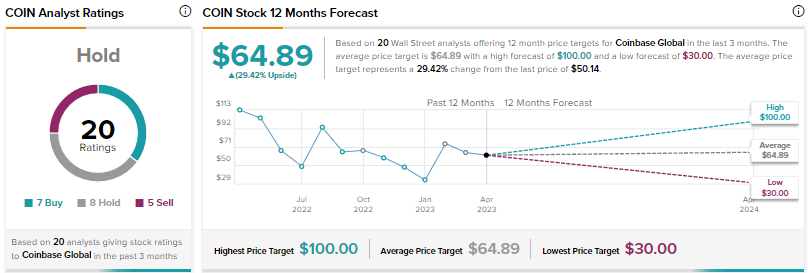

Wall Street is sidelined on Coinbase stock, with a Hold consensus rating based on seven Buys, eight Holds, and five Sells. At $64.89, the average price target implies 29.4% upside from current levels. Shares have declined about 26% over the past month but are still up about 42% year-to-date.