Coinbase (COIN) is under fire for its decision to delist Wrapped Bitcoin (WBTC), tying the move to risks associated with Tron founder Justin Sun. In a Dec. 17 court filing, Coinbase cited allegations of financial misconduct and regulatory investigations against Sun as reasons for the delisting. Sun, who has faced fraud charges from the U.S. SEC and investigations by federal authorities, was described in the filing as having “repeatedly been accused of financial misconduct.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Crypto Community Criticizes Lack of Technical Justification

The delisting has sparked outrage within the crypto community, with critics accusing Coinbase of “guilt by association.” Bitcoin advocate Pledditor claimed on X, “It’s basically just they don’t like Justin Sun,” highlighting the lack of technical reasoning. Adding to the irony, VanEck adviser Gabor Gurbacs pointed out Coinbase’s own legal troubles in an X post, including an ongoing SEC lawsuit and a $100 million settlement with New York regulators earlier this year.

As Coinbase battles regulatory challenges, this incident raises questions about consistency in crypto governance. Some worry Coinbase’s actions might “bring out skeletons from their own closet,” further complicating its strained relationship with regulators.

Is COIN Stock a Good Buy?

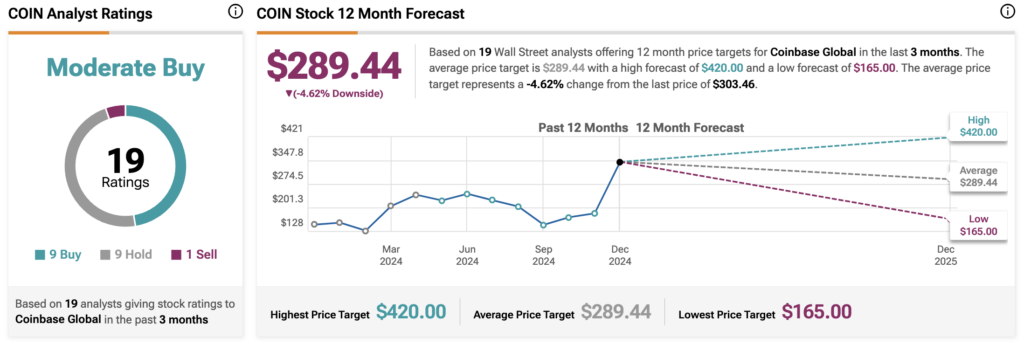

Analysts remain cautiously optimistic about COIN stock, with a Moderate Buy consensus rating based on nine Buys, nine Holds and one Sell. Year-to-date, COIN stock has increased by more than 75%, and the average COIN price target of $289.44 implies a downside potential of 4.6% from current levels.