Crypto exchange Coinbase (COIN) announced in a blog post today that it has added two new features to its Coinbase Business platform: global payouts and payment links. Interestingly, these updates are designed to address common issues with business payments, such as high fees, slow processing times, and cross-border delays. As a result, businesses can now send and receive USDC stablecoins (USDC-USD), digital dollars tied to the U.S. dollar, more quickly and at lower cost.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With global payouts, companies can send USDC to any crypto wallet or even an email address. There are no gas fees for recipients using supported networks like Base, and funds can come from either a Coinbase balance or a linked bank account. If the recipient doesn’t have a wallet, they will get an email to create a free Coinbase account and cash out locally. An API is also available so businesses can automate these payments, whether on demand, in batches, or on a set schedule. Coinbase says this reduces errors, speeds up transactions, and simplifies working with international vendors.

For receiving payments, Coinbase now offers payment links that allow businesses to request USDC instantly. Customers can pay using wallets like Base, MetaMask, or Phantom without fees or chargebacks. In addition, payments settle in under a second and avoid the 3% fees that usually come with credit cards. A Payment Links API will also allow developers to generate links at scale, which is ideal for apps or e-commerce sites. Moreover, businesses earn 4.1% APY on USDC held in Coinbase and can cash out to a bank via wire or ACH.

Is COIN a Good Buy Now?

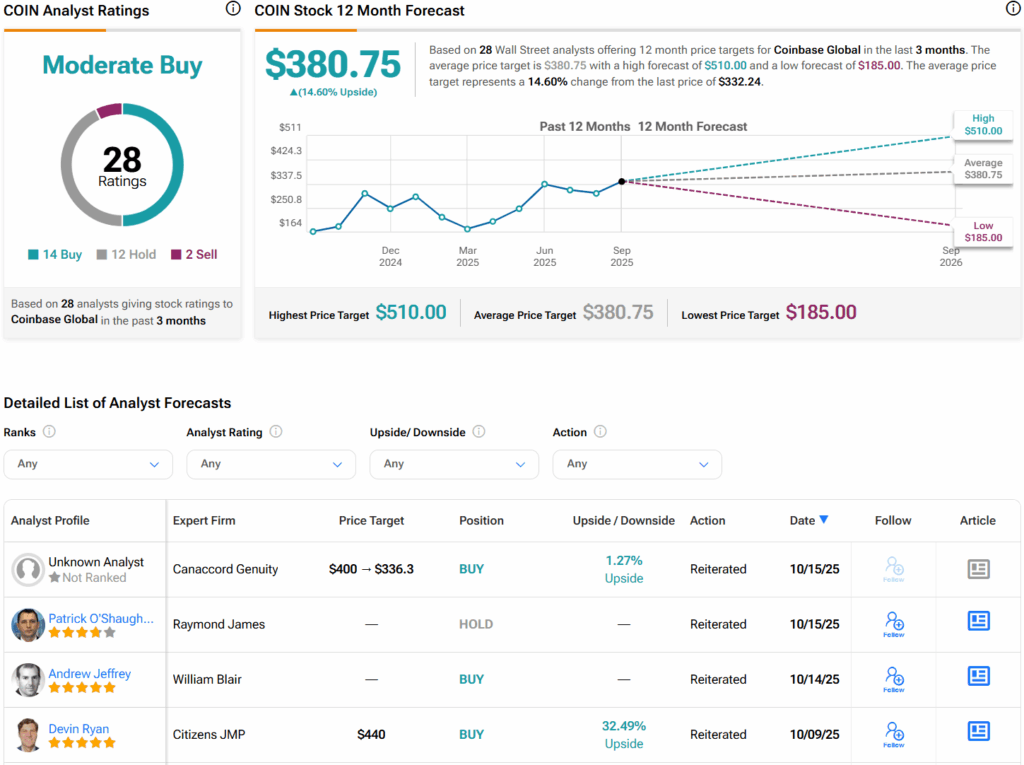

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 14 Buys, 12 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average COIN price target of $380.75 per share implies 14.6% upside potential.