In the aftermath of a recent surge in its shares, cryptocurrency exchange Coinbase Global (NASDAQ:COIN) has been downgraded from Equal Weight to Underweight by Barclays. This decision comes as the company grapples with a slump in trading volumes and the USCoin (USDC-USD) market cap, as well as looming regulatory concerns. As a result, COIN stock slipped at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a note to clients, Barclays analyst Benjamin Budish maintained that despite the difficulties Coinbase faces in the short term, the company is poised to be a significant player in the broader crypto landscape in the long run. Budish pointed out that Q2 trading volumes were down 36% from Q1, and July’s metrics appear even more concerning. With increasing competition from traditional finance-backed exchanges and ongoing regulatory uncertainties, these challenges are unlikely to dissipate quickly.

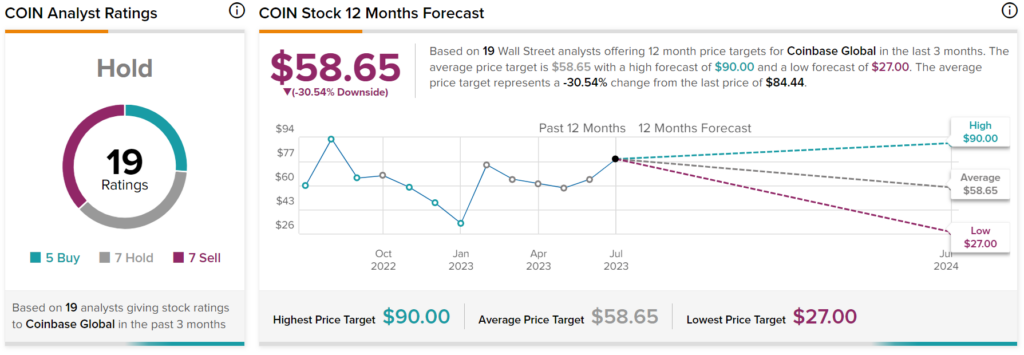

Is COIN Stock a Buy or Sell?

Turning to Wall Street, analysts have a Hold consensus rating on COIN stock based on five Buys, seven Holds, and seven Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $58.65 per share implies 30.54% downside risk.