Shares of Coherent jumped nearly 13.8% on Feb. 12 after the provider of lasers and laser-based technologies received a buyout offer from II-VI. The cash and stock deal has a total enterprise value of $6.5 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Per the terms of the unsolicited acquisition proposal, the manufacturer of engineered materials and optoelectronic components has proposed to pay $130 in cash and 1.3055 shares of II-VI for each share of Coherent (COHR). The total value, which comes in at $260 per share, represents a 14.6% premium to COHR’s closing price on Feb. 11. Shares of II-VI dropped 9.7% at the close on Feb. 12.

After closure, II-VI (IIVI) expects the deal to be accretive to adjusted EPS in the second year. Combined run-rate synergies of $200 million are likely to be realized annually within thirty-six months.

Last month, Coherent entered into a cash-stock deal with California-based manufacturer of optical and photonic products, Lumentum Holdings, to be acquired for $100 in cash and 1.1851 shares of Lumentum (LITE) common stock for each share of Coherent.

Earlier this week, the company also received an unsolicited acquisition proposal from MKS Instruments, in which each share of Coherent common stock would be exchanged for $115 in cash and 0.7473 per share of MKS (MKSI) common stock.

II-VI’s offered price reflects a 24% premium to the implied value of the Lumentum deal and a 9.8% premium to the implied value of MKS Instruments’ buyout proposal. II-VI’s proposal is undergoing Coherent’s board of directors’ review. (See Coherent stock analysis on TipRanks)

The pending merger deal with Lumentum along with the proposed offers of MKS and II-VI are all subject to customary closing conditions, which includes U.S. and foreign antitrust approvals as well as stockholder approvals.

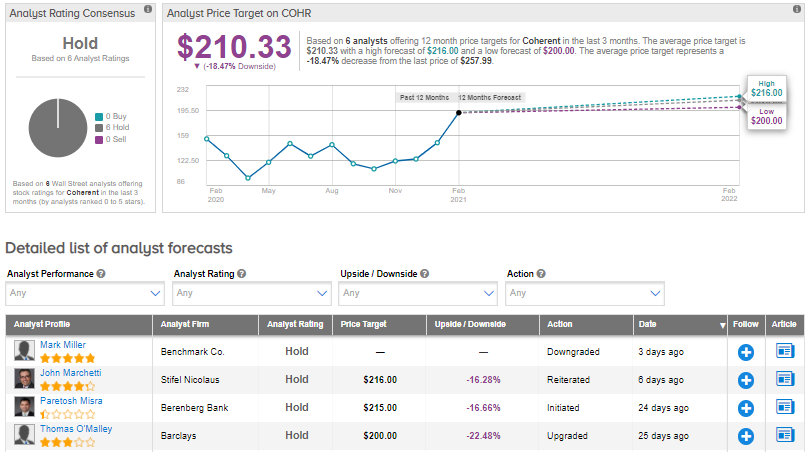

On Feb. 11, Benchmark Co. analyst Mark Miller downgraded the rating to Hold from Buy, as he is “awaiting the decision on what firm will acquire Coherent.”

Meanwhile, the Street’s consensus rating on the stock is a Hold. That’s based on a unanimous 6 Holds. Looking ahead, the average analyst price target stands at $210.33, putting the downside potential at about 18.5% over the next 12 months. Shares have jumped 65.6% over the past year.

Related News:

Coherent Gets $6B Rival Buyout Offer From MKS; Shares Jump 13.6%

Zimmer Biomet To Spin Off Spine and Dental Businesses

Electronic Arts To Buy Glu Mobile For $2.1B; Shares Pop 34%