Cognizant Technology Solutions Corp. (CTSH), an American multinational technology company, has reported solid fourth-quarter 2021 results. Shares of the company fell 2% in Wednesday’s extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings per share (EPS) rose 64.2% year-over-year to $1.10, surpassing the Street’s estimate of $1.04 per share. Total revenues soared 14.2% to $4.8 billion, marginally outpacing the consensus estimate of $4.78 billion.

Financial Services revenue (32.3% of net sales) increased 18.5% to $1.55 billion. Products and Resources revenue rose 17.7% and Healthcare revenue jumped 7.9%.

According to the company, bookings during the quarter grew 22% year-over-year, bringing full-year 2021 bookings of $23.1 billion.

The CEO of Cognizant, Brian Humphries, said, “We successfully executed our strategy by meaningfully enhancing our digital portfolio, strengthening our international presence, and helping our clients be successful. We enter 2022 with momentum and confidence that our talented employees position us to capture the substantial market opportunity.”

Outlook

Looking ahead, Cognizant expects first-quarter 2022 revenues to be between $4.80 billion and $4.84 billion. For full-year 2022, the company anticipates revenue to be in the range of $20 billion to $20.5 billion and adjusted EPS in the range of $4.46 to $4.60.

Dividend Hike

Alongside earnings, the company announced plans to raise quarterly common stock dividend to $0.27 per share, up 12% from the previous payout. The dividend is payable on March 1, 2022, to shareholders of record on February 18, 2022.

Stock Rating

The Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 7 Buys and 4 Holds. The average Cognizant price target of $95.50 implies 8.2% upside potential.

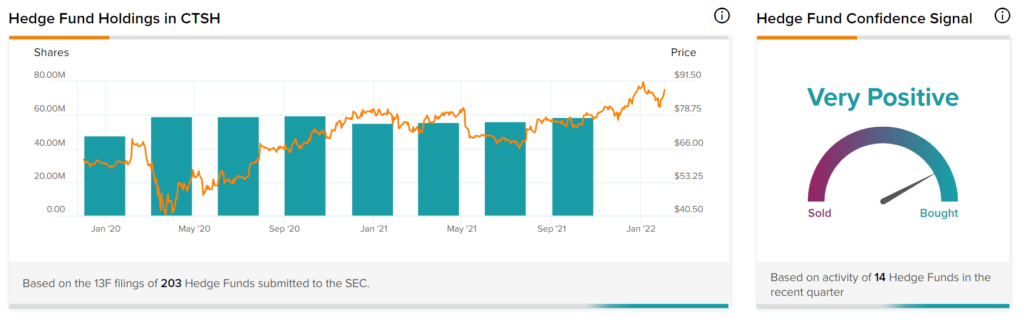

Hedge Fund Trading Activity

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Cognizant is currently Very Positive, as the cumulative change in holdings across all 14 hedge funds that were active in the last quarter was an increase of 2.5 million shares.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Boston Scientific Reports Strong Q4 Results

AbbVie Posts Mixed Q4 Results & Upbeat FY22 Outlook

Corteva Sinks 3.9% on Q4 Earnings Miss